The Australian Housing Market: 2023 in charts with CoreLogic

16 January 2024

Abdullah Popal

Managing Director

The Australian housing market defied expectations in 2023, showcasing surprising resilience in the face of rising interest rates. While whispers of a downturn swirled, the reality painted a different picture: property prices rebounded in many regions, even reaching new highs.

This resilience can be attributed to several factors, including:

- Persistent housing shortage: The supply of homes for sale remains limited, particularly with Australia’s robust population growth. This imbalance continues to exert upward pressure on prices and rents.

- Strong underlying fundamentals: The Australian economy remains healthy, with low unemployment and rising wages. This provides stability and confidence for potential buyers.

- Potential stabilisation of interest rates and inflation: Recent indications suggest that the rapid rise in interest rates may be nearing its peak. Additionally, inflation appears to be coming under control. This could lead to renewed buyer activity in the near future.

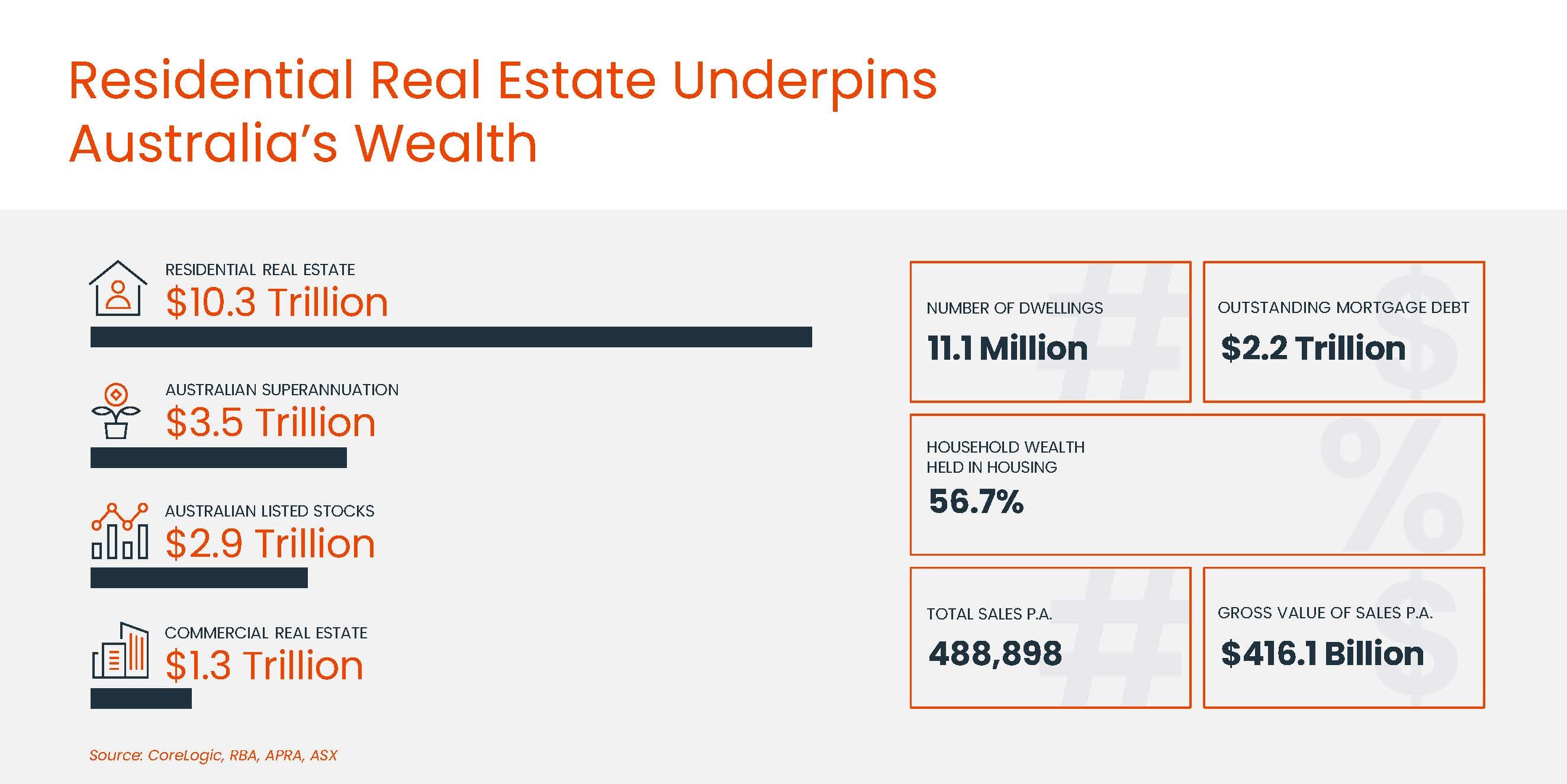

Residential real estate underpins Australia’s wealth

Australian housing reached a record $10.3 trillion valuation – This towering valuation also reflects the significant role residential real estate plays in Aussie household wealth. A staggering 56.7% of total household wealth is locked in bricks and mortar, making the property market a critical pillar of the nation’s financial ecosystem. This steady ascent, achieved month after month, also paints a picture of resilience in the face of rising interest rates.

While the total value is undoubtedly impressive, what truly sparks curiosity is the relatively low level of outstanding mortgages. Aussie homeowners only owe $2.2 trillion on their properties, translating to a comfortable 22% Loan-to-Value (LTV) ratio. This indicates a healthy balance between property worth and debt incurred, suggesting some financial breathing room for many home-owners.

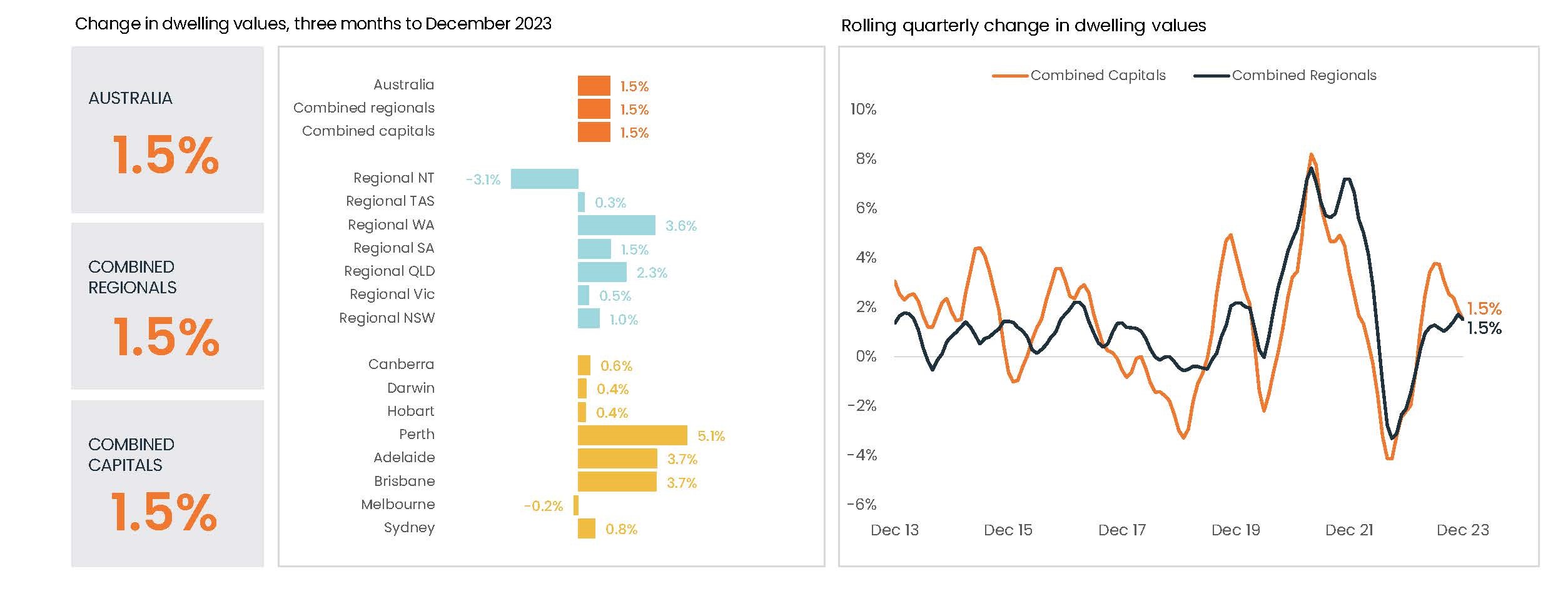

Continued growth as seen from rising dwelling values in December

Both the combined capital city dwelling market and the regional dwelling market saw a 1.5% rise in the December quarter, a steady pace that reflects the market’s resilience in the face of rising interest rates.

Growth trajectory for housing values in the combined capitals has slowed since late May, but remained relatively steady through January 10th.

This positive trend is driven by a persistent shortage of available housing supply colliding with rising demand.

Regional markets are experiencing a similar upward trend, with their 1.5% quarterly growth mirroring the national average. This suggests a broader strength in the housing market, extending beyond the major metropolitan centres.

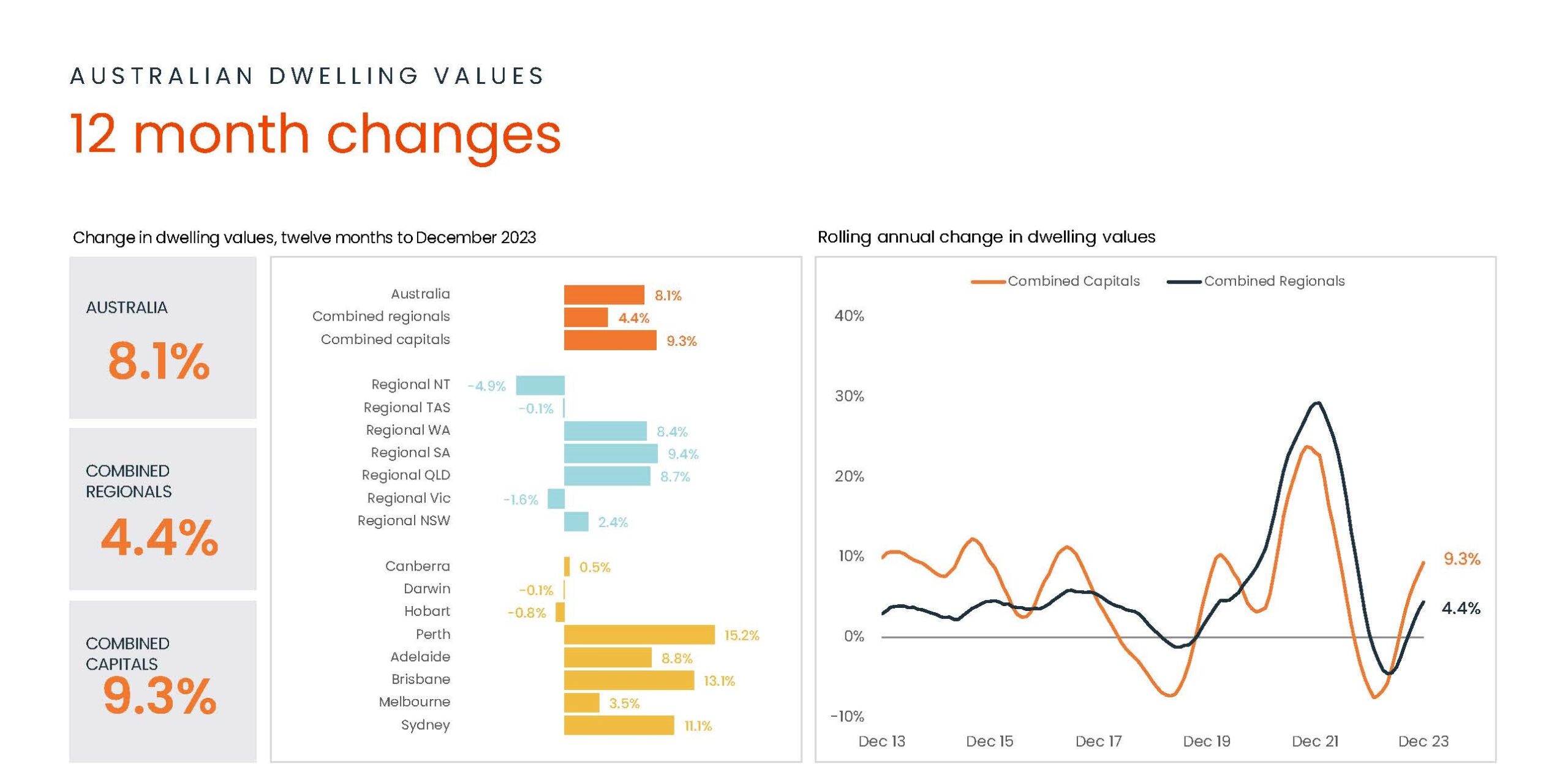

Home values across the country increased 8.1% in the 2023 calendar year, marking a significant turnaround from the -4.9% fall in 2022. While this growth is impressive, it’s worth noting that it falls short of the 24.5% surge witnessed in 2021.

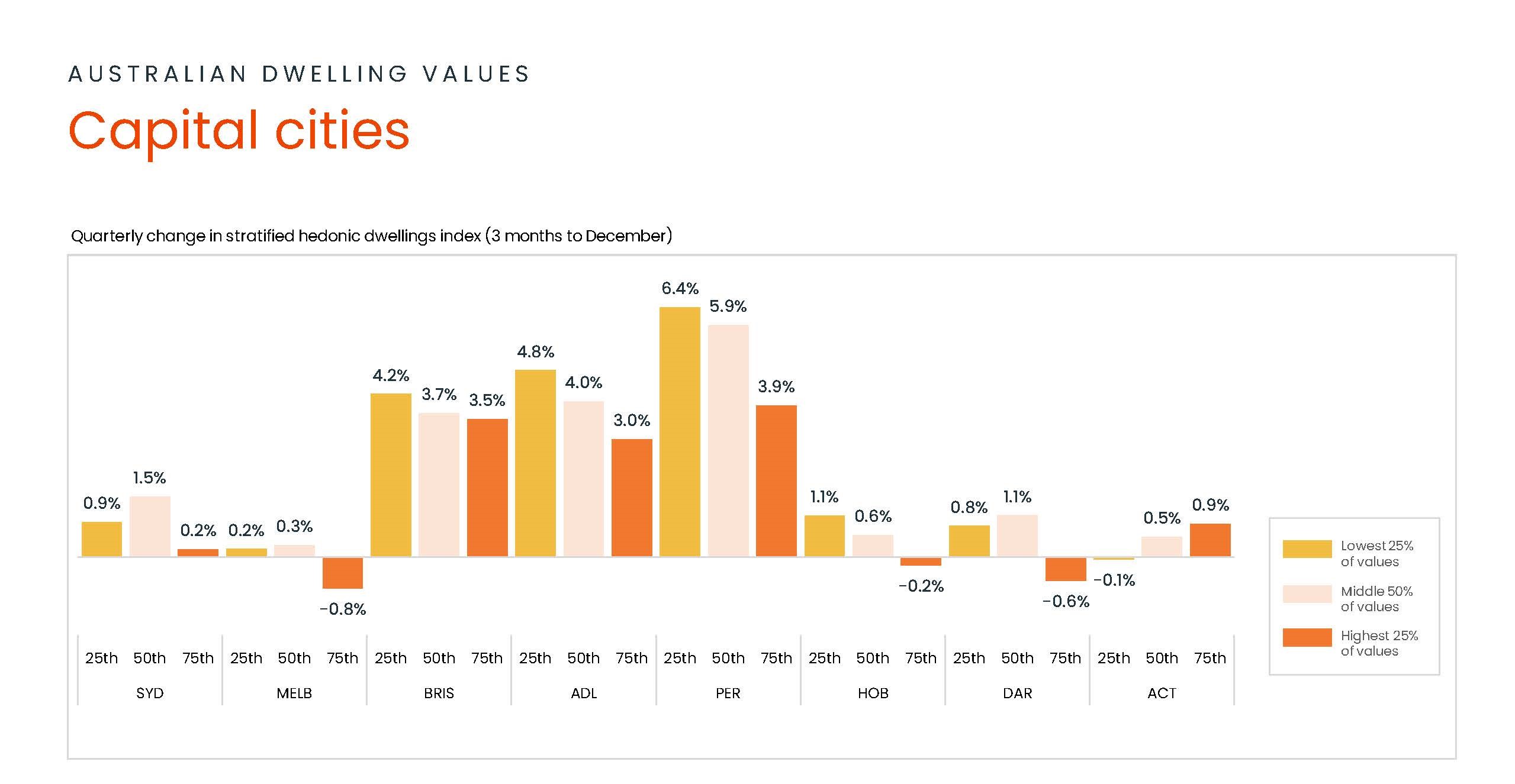

Our capital city markets are fragmented

The Australian housing market exhibits significant fragmentation.

From the chart below, you’ll see that capital cities are outpacing their regional counterparts when it comes to price increases.

While not as dramatic as the city surge, regional markets are also experiencing positive growth, mirroring the national average with a 1.5% quarterly increase.

The fragmented nature of the Australian property market means that while most segments are growing, some pockets remain sluggish.

The below chart shows how various segments of the capital city market are performing differently with median priced properties doing well. The more expensive segments of the market that lead the initial downturn are now spearheading the upswing’s early stage.

This volatility in the upper quartile of the market is nothing new, but it begs the question: where should astute investors turn their attention?

Investors should carefully research specific regions and property types to identify opportunities with strong potential.

Each State is running its own race

Across the cities, the charts reveal divergent performances – here is a snapshot of the contrasting situations unfolding:

- Perth: Soaring 15.2% over the year, Perth reaches record highs, fueled by strong economic tailwinds and limited housing supply. Investors seeking exposure to a dynamic market should keep Perth on their radar.

- Brisbane: Matching Perth’s exuberance, Brisbane’s 13.1% climb to record highs underscores its attractiveness as a growing economic hub. Consider focusing on areas with robust infrastructure and job markets.

- Sydney: Despite a respectable 11.1% annual increase, Sydney prices linger 2.1% below their peak. Cautious optimism may be warranted; target established suburbs with good long-term growth prospects.

- Melbourne: Downward pressure persists in Melbourne, with prices down 0.3% in December and 4.1% off their March 2022 peak. Selectively target resilient pockets, focusing on affordability and infrastructure upgrades.

- Hobart: The former darling, Hobart, faces a 11.2% correction from its March 2022 peak. A wait-and-see approach might be prudent, with careful analysis of local economic factors before considering entry.

- Adelaide: The Adelaide market languished last year, offering potential value for long-term investors who can ride out potential short-term volatility.

- Darwin: Darwin underperformed in the past year, but its resource-linked economy could rebound. Monitor closely for signs of recovery and infrastructure investments before committing.

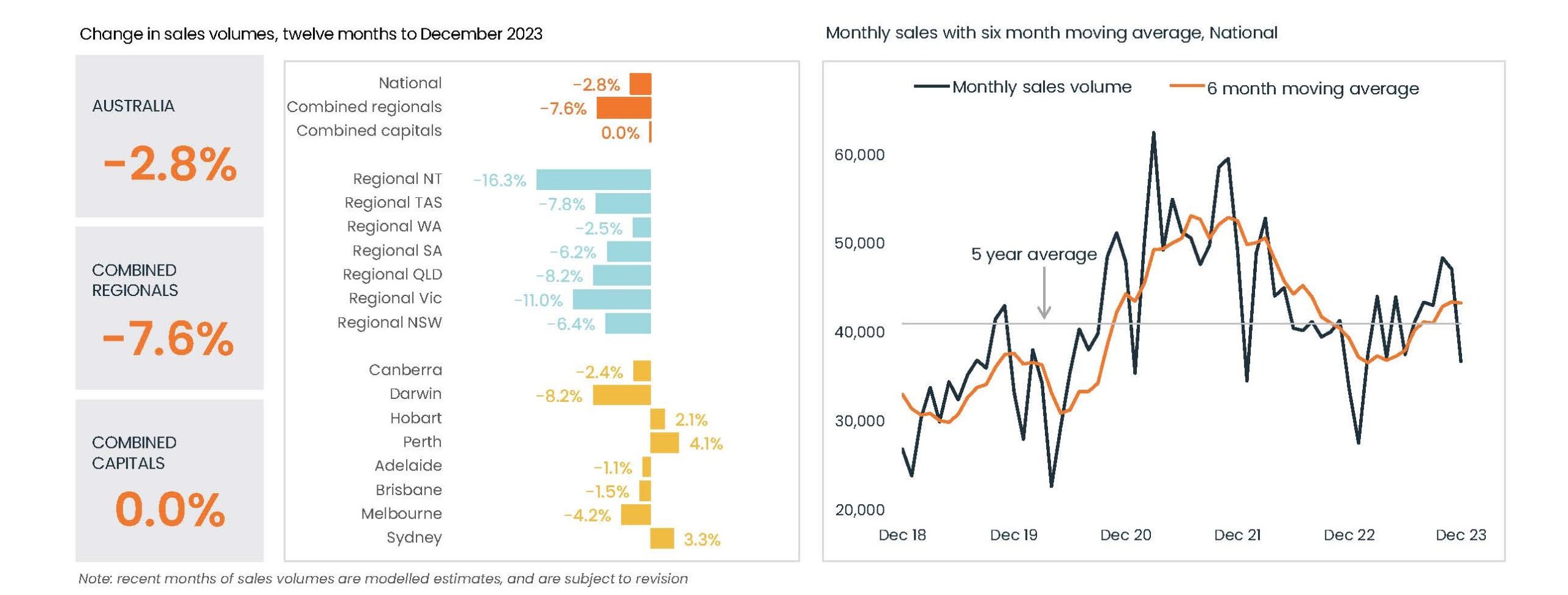

Sales volumes are trending a little higher than the historic monthly five-year average

CoreLogic estimates around 488,898 sales across the country in 2023. That’s still a significant volume, indicating continued activity in the market.

National sales volumes surpassed the historical five-year average, except for the expected seasonal decline in December.

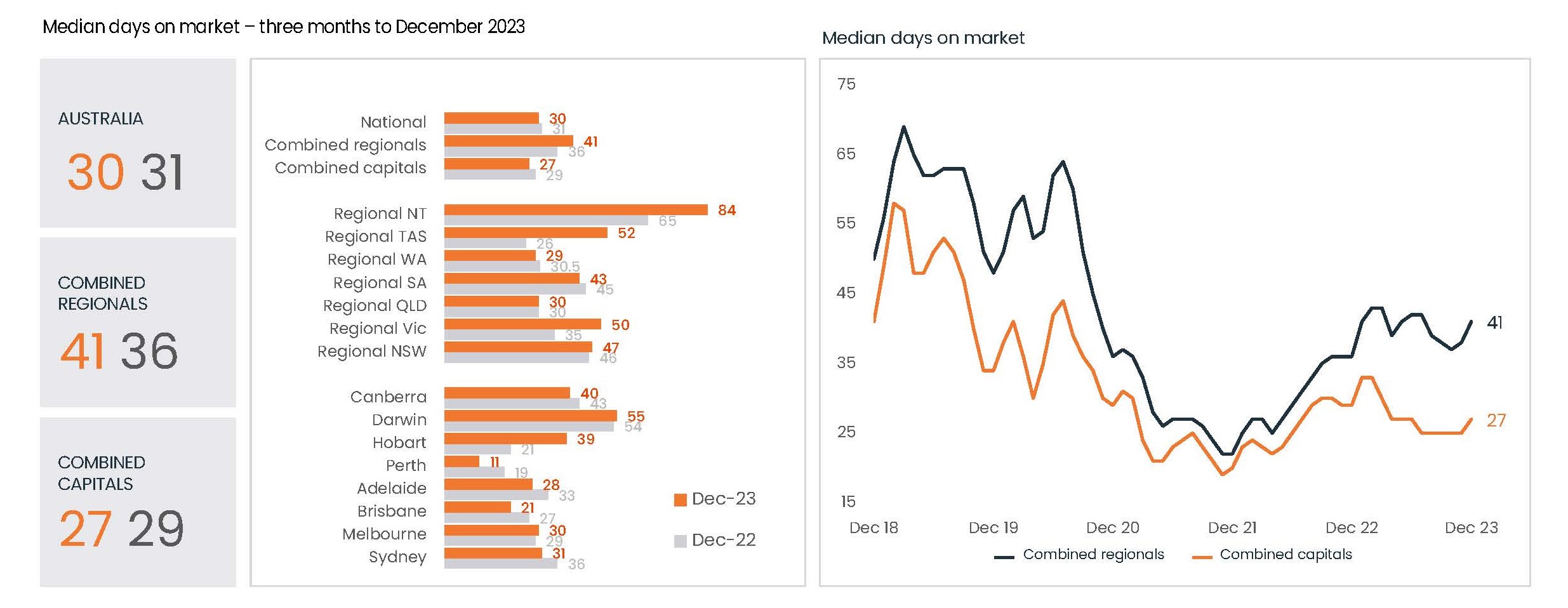

We’ve moved into a more balanced market

The market seems to be finding its equilibrium. While selling times ticked up in capital cities last quarter, they were consistently dropping earlier in the year.

Regional sales are taking a slower pace, but that’s partly due to pre-pandemic trends returning. Importantly, it’s still significantly faster than the typical time before COVID.

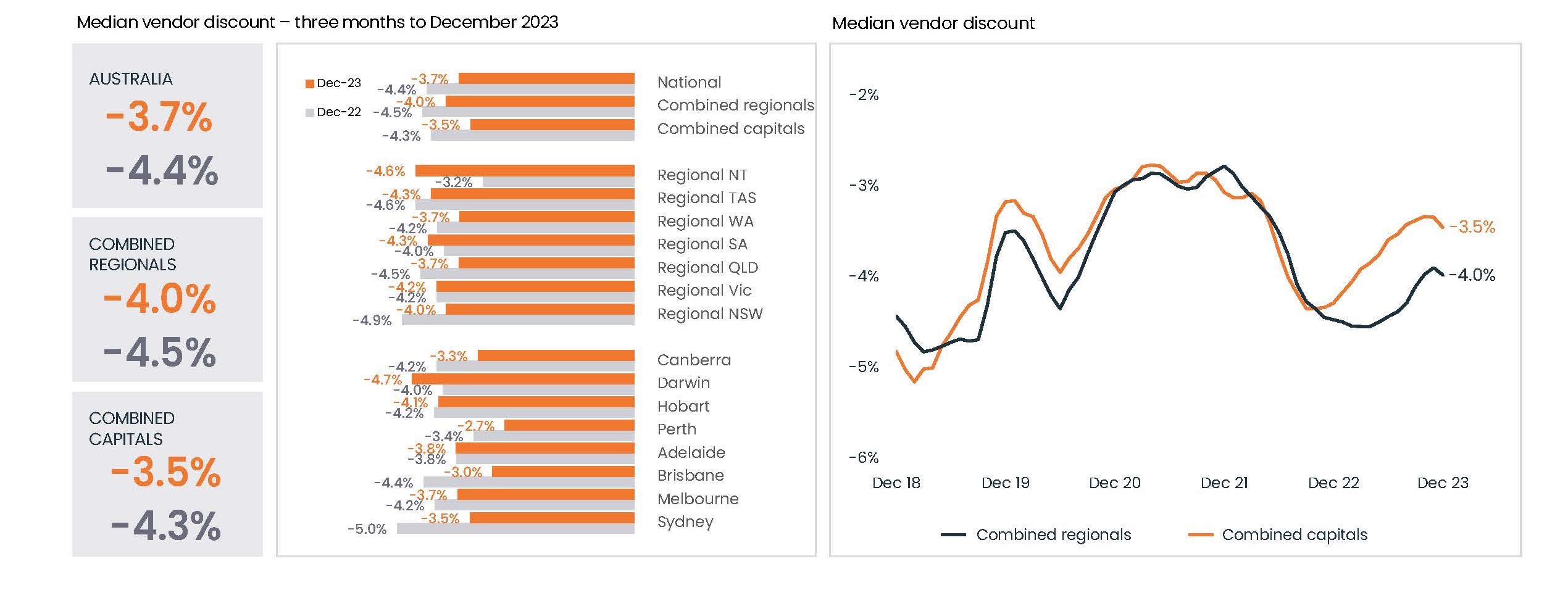

Vendor Discounting

As houses sold faster in 2023, the average amount sellers had to discount their prices dropped steadily. In major cities, it went from 4.3% in December 2022 to 3.5% a year later.

The latter part of 2023 saw a small increase in average price drops by sellers, suggesting a slight shift in market dynamics.

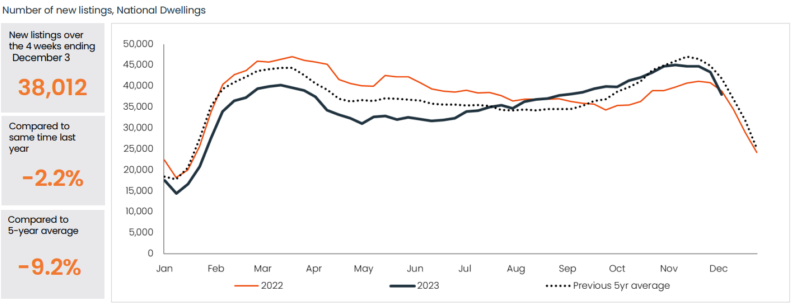

New listings: A tale of two halves for property investors

New listings paint a complex picture for Australian property investors, revealing a market in transition.

A total of 38,012 dwellings were listed nationally in the four-week period ending December 3rd.

New listings in the second half of 2023 closely matched the historical five-year average, suggesting a return to normalcy after a period of tight supply. This signifies increased market activity and potential opportunities for buyers.

Total listings across the country are slowly rising, driven by the second-half influx, even though they remain slightly below the historical average. This could indicate a gradual build-up of available properties in the coming months.

As expected, December saw a slight drop in new listings, a seasonal pattern likely to continue in the short term.

The catch? Many of these new listings may not be the “A-grade” or investment-worthy properties investors crave. Quality property owners remain cautious, keeping their prized assets off the market, potentially limiting options for discerning buyers.

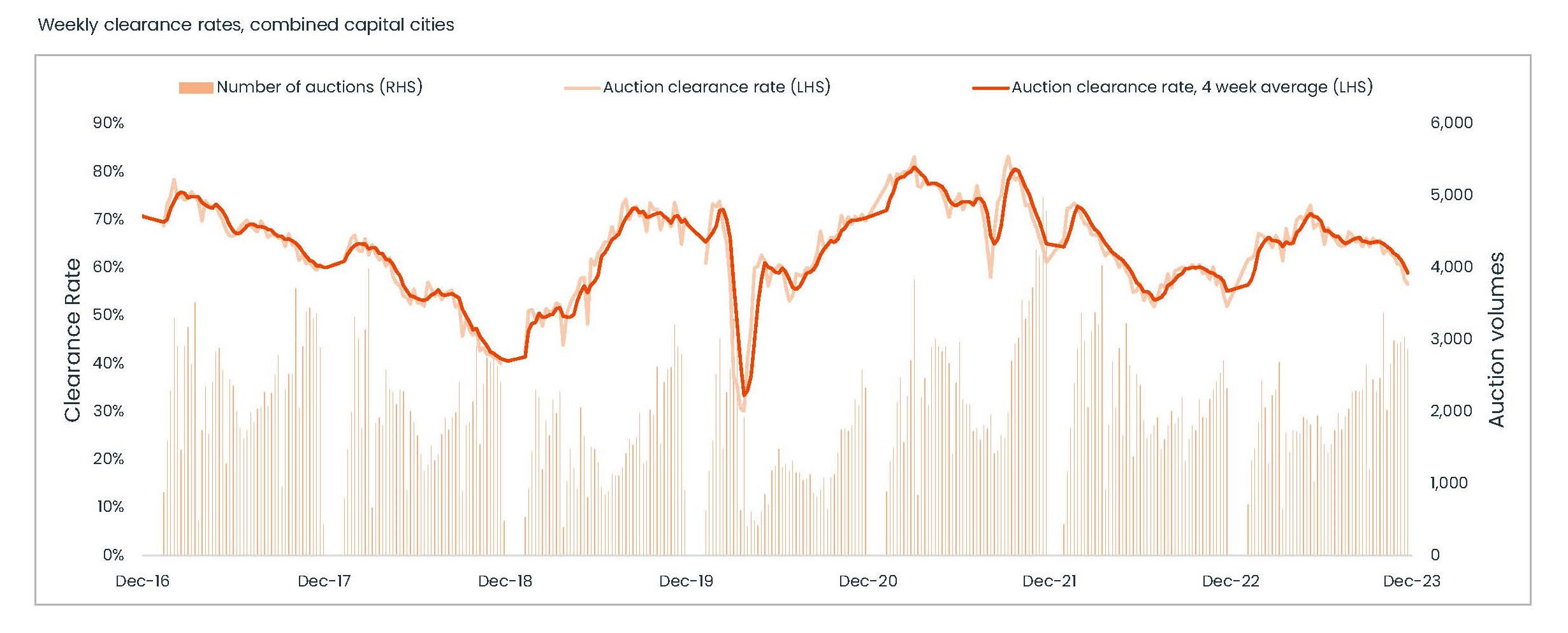

Auction clearance rates in major cities dipped from November’s peak, signaling a potential shift in the housing market cycle.

After a strong run, auction success rates cooled down towards the end of 2023, suggesting a return to normalcy after a hot market.

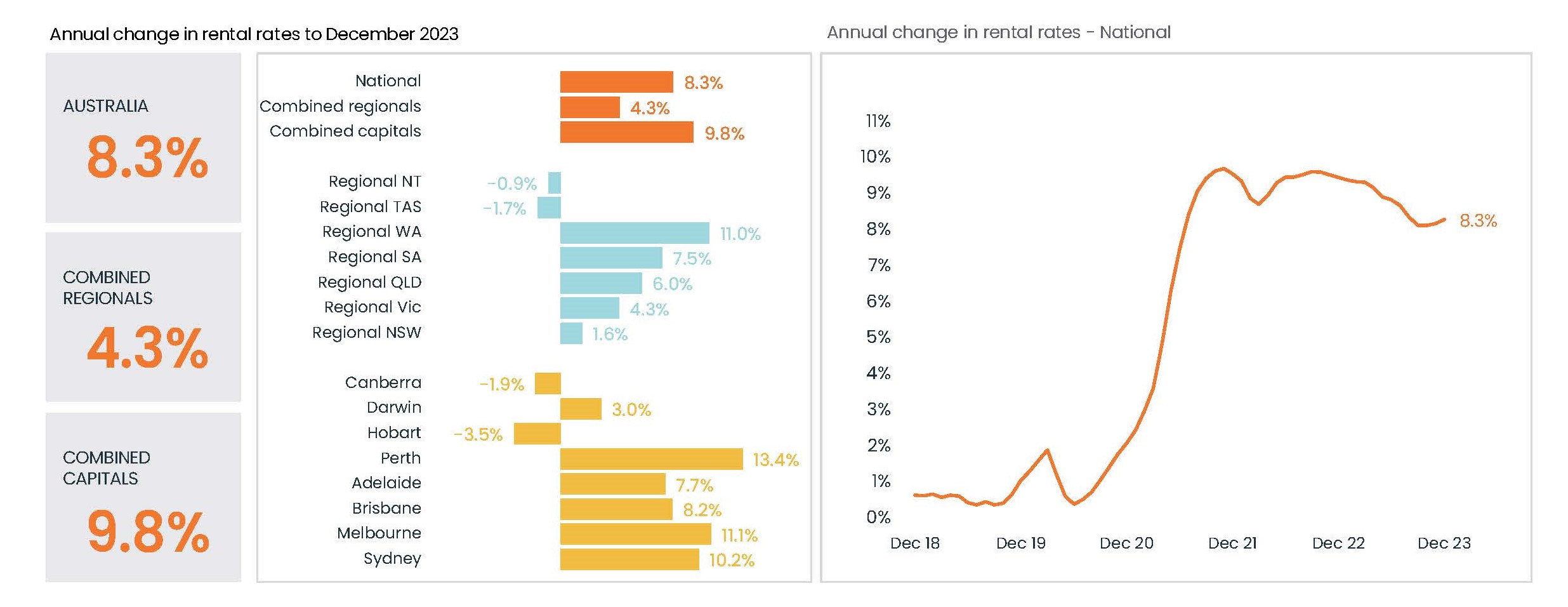

We’re experiencing a rental market crisis in Australia

The Australian rental market continues to be a hot topic, with headlines screaming “crisis” and numbers pointing to rising costs.

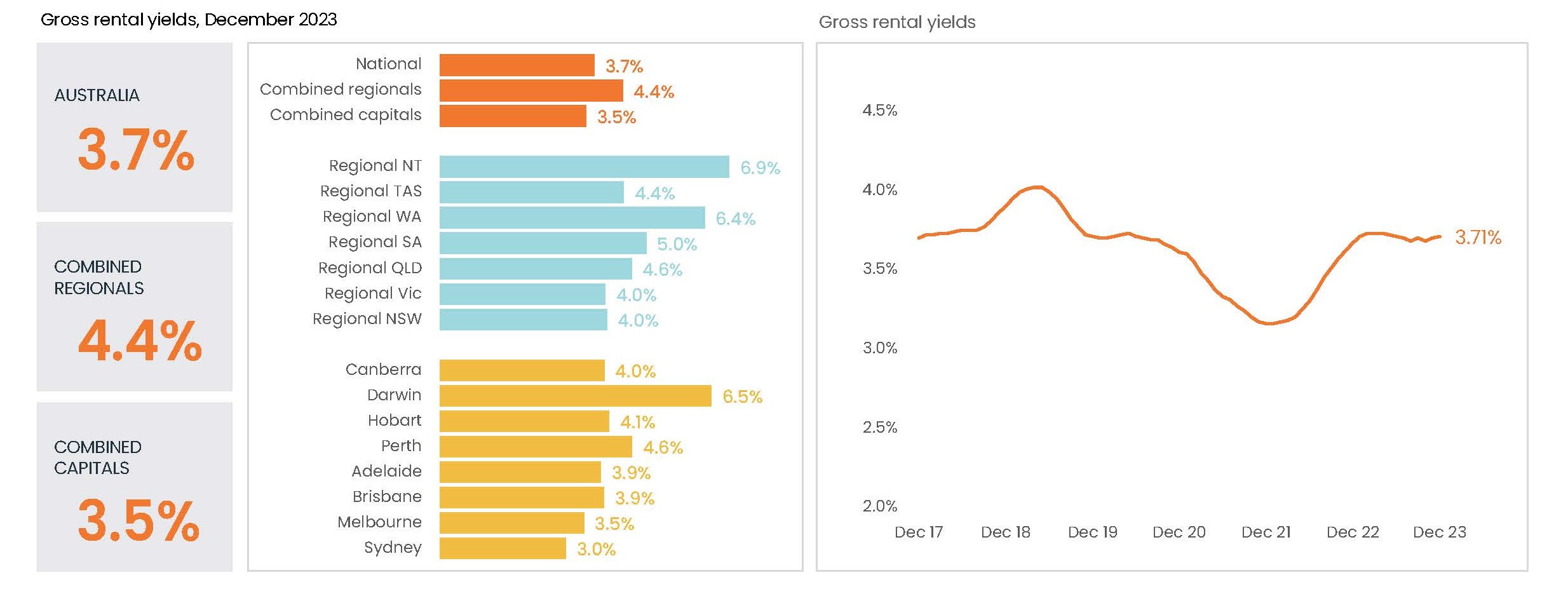

Rent values across the country climbed another 0.6% in December, reflecting an 8.3% annual increase. That’s slightly higher than the 8.1% recorded in October, indicating continued upward momentum.

Additionally, a slight slowdown in capital gains growth, coupled with the rent uptick, has pushed gross rental yields marginally higher in recent months.

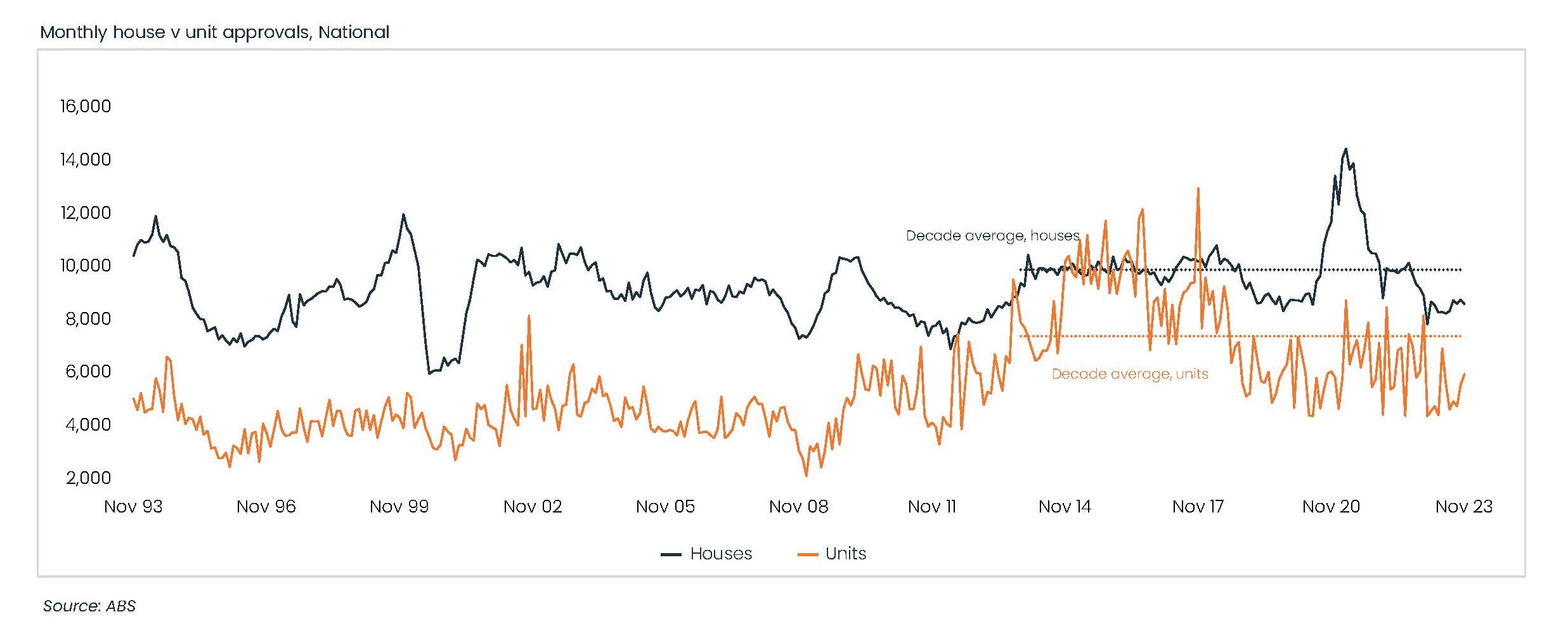

Dwelling approvals and housing credit

Approvals remain significantly below historical averages. Looking at the past six months, the average was a modest 13,760 per month, far from the decade-long average of 17,254.

This discrepancy suggests that despite pockets of activity, construction activity continues to lag behind pre-pandemic levels.

Finance and Lending – First-home buyers fuelling the fire

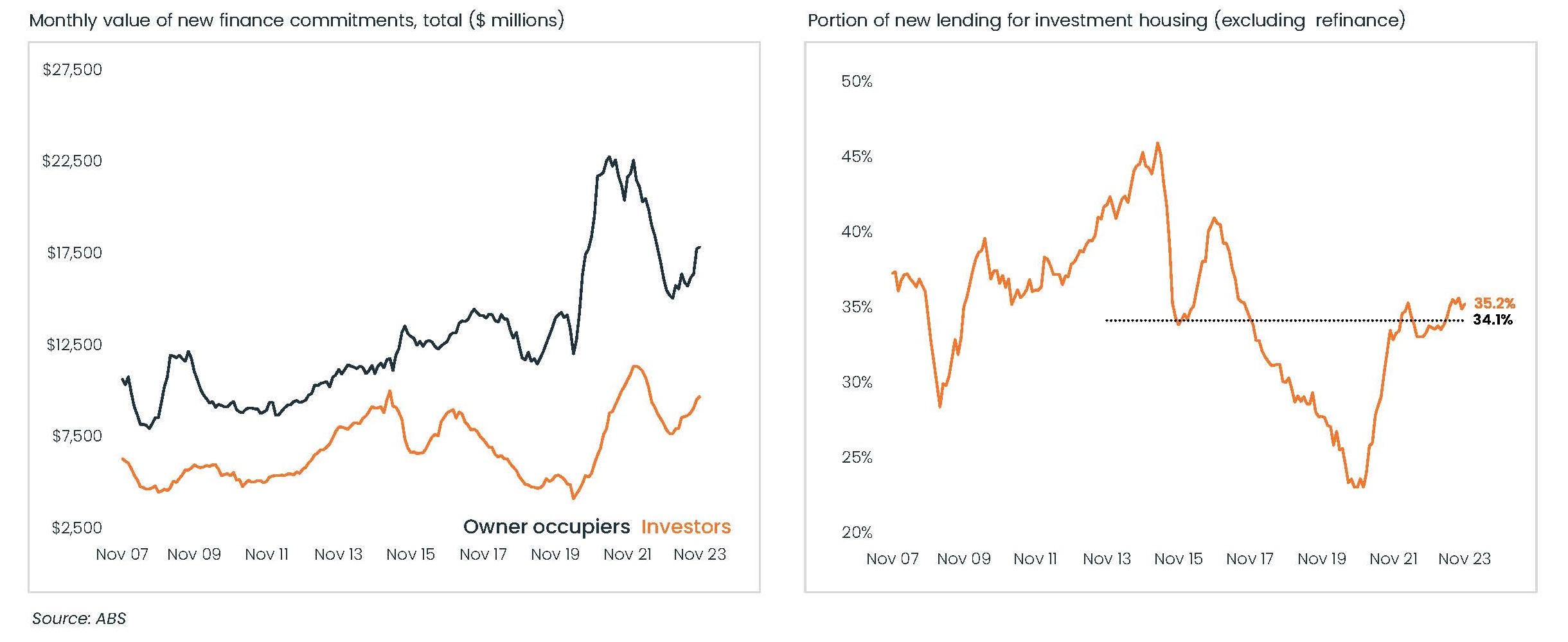

The value of new housing loans approved in November climbed a modest 1.0%, a significant dip from the 7.1% surge in October. This suggests a potential cooling down of the loan frenzy we saw earlier in the year.

First-home buyers are stealing the show. Their loan approvals jumped 2.8%, pushing their share of total owner-occupier loans to a whopping 29.4%. That’s way above the historical average of 24.3%!

Queensland seems to be leading the charge, with a 73.3% increase in first-home buyer loans, likely fueled by a temporary government grant boost for new builds.

Don’t count investors out just yet. Their loan approvals also saw a 1.9% increase in November, indicating continued interest in the property market.

Our tips for success in navigating the evolving property market

- Adopt a strategic approach: Analyse specific market segments and tailor your investment strategy accordingly. While price points influence performance, location remains paramount. Identify suburbs within your chosen city experiencing strong economic indicators and infrastructure development with strong fundamentals and long-term growth potential, regardless of temporary trends.

- Maintain flexibility: Be prepared to adapt your strategy as market conditions evolve. Stay informed about lending data, economic indicators, and government policies to make informed decisions.

- Seek professional advice: Consult with financial and property investment experts to navigate the complex market landscape and identify suitable investment opportunities that align with your risk tolerance and financial goals. Click here to start a conversation with Wealth Street today.

Get Started

Every success story starts with a leap of faith. Start a conversation with us.