Australian real estate soars to $10 trillion: CoreLogic September housing chart update

20 September 2023

The release of CoreLogic’s September Monthly Housing Chart Pack provides a comprehensive look at the Australian housing market trends up until August 2023.

Here’s a snapshot of what happened in August:

- Australian real estate market value surpassed $10 trillion mark since June 2022. This is a result of increased migration, decreased reliance on lending and tighter competition for purchase and rent.

- Net overseas migration forecast to be 268,000 higher than expected from 2022–23 to 2024–25, further putting pressure on the rental and sales market.

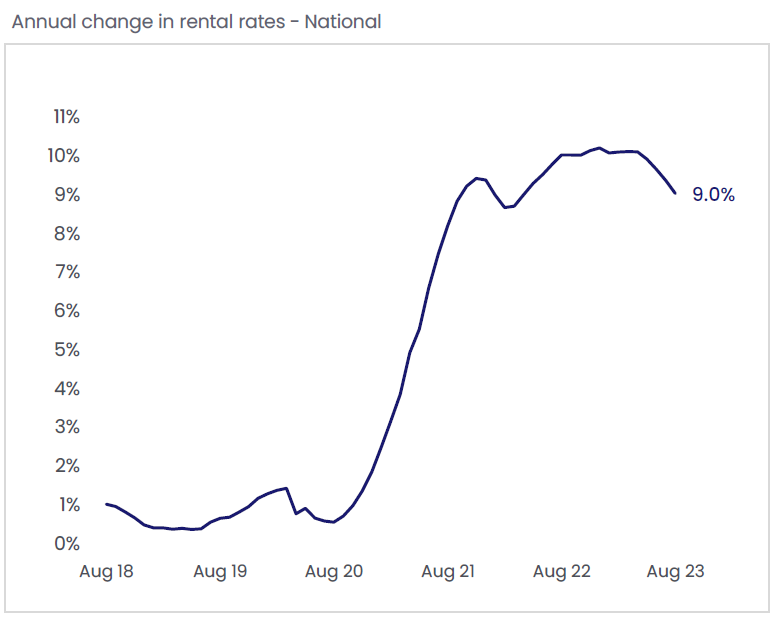

- Rent values increased another 0.5% in August, bringing national annual increase to 9%.

- Home values currently -4.6% below peak in April 2022.

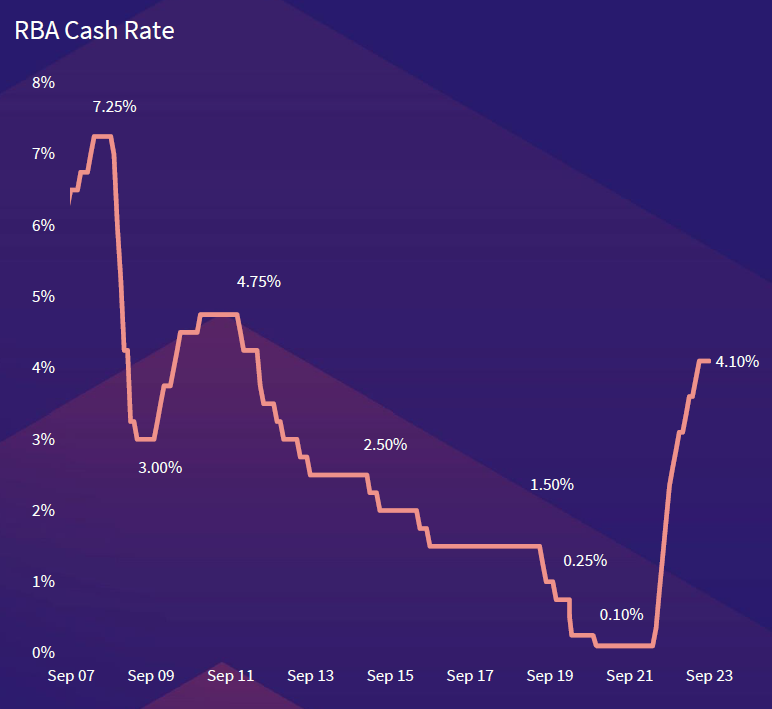

- RBA maintained the cash rate at 4.1% in September, the second consecutive pause. Lower inflation and an expectation that interest rates have peaked may boost consumer sentiment.

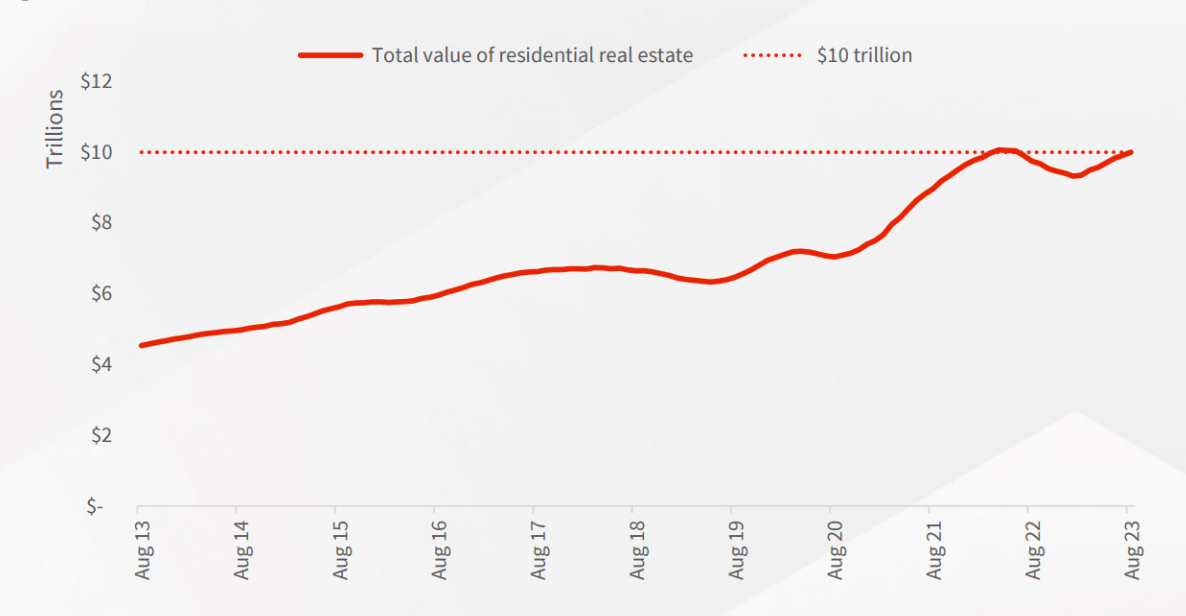

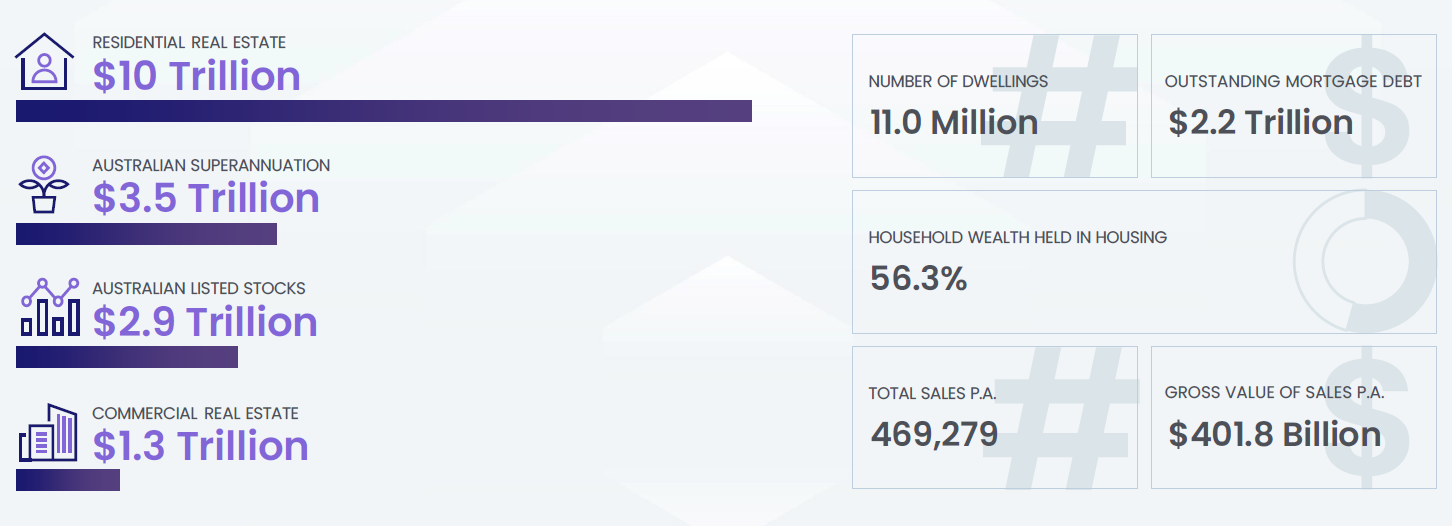

Australia’s real estate hit a massive 10 trillion in value

Australia’s real estate market surpassed the $10 trillion mark for the first time since June 2022. This turnaround began in March 2023, with home values rising by 4.9% through August.

This recovery has reversed nearly half of the previous downturn (-9.1%) between April 2022 and February 2023. Presently, home values are just -4.6% below the peak in April 2022.

But how is this recovery possible given rising living costs and twelve consecutive interest rate hikes?

Three factors contribute:

- Increased overseas migration: More people moving to Australia have boosted housing demand.

- Less borrowing, reliance on savings: Australians are borrowing less and saving more, promoting financial stability.

- High demand, lower supply: Strong demand and limited housing supply continues to drive property values upward.

These factors underline the resilience of Australia’s real estate market in adapting to changing economic conditions, highlighting the enduring appeal of property investment.

Increased overseas migration

The National Housing Finance and Investment Corporation (NHFIC) reports rising demand due to more people returning and fewer departing from overseas.

Net overseas migration is expected to exceed previous estimates by 268,000 from 2022–23 to 2024–25.

This increase in population has led to higher competition for rental properties. NHFIC predicts a shortage of around 175,000 dwellings in Australia’s housing sector by 2027, further supporting housing prices.

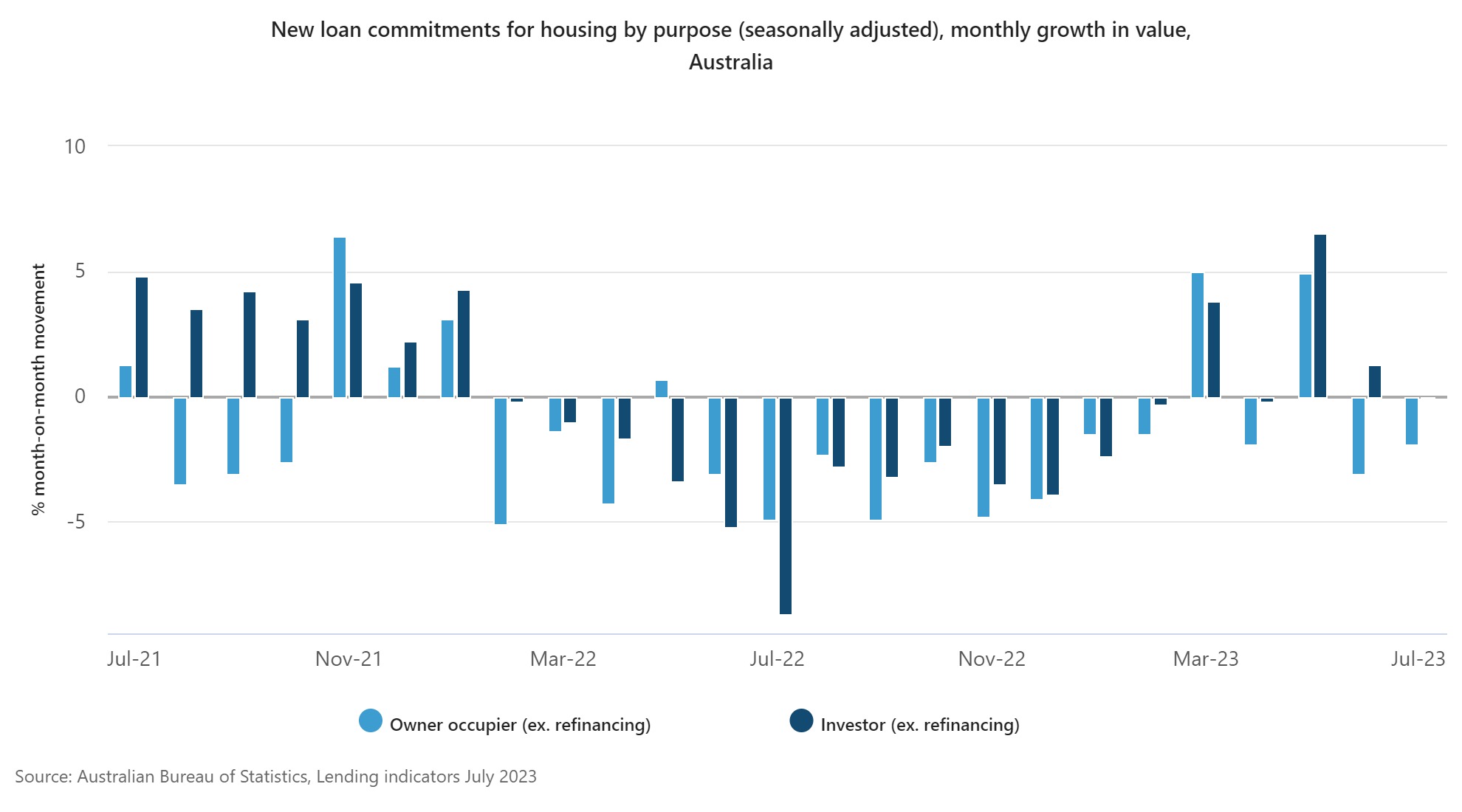

Reliance on savings

Buyers are increasingly using savings, equity, or property profits instead of bank loans for property purchases.

This explains the rise in home values despite reduced lending activity reported by the ABS in June and July 2023. According to the ABS, in July 2023 in seasonally adjusted terms, the value of new loan commitments:

- For owner occupiers fell 1.9%, after a fall of 3.1% in June

- For investors fell 0.1%, after a rise of 1.3% in June

High demand, lower supply pushing up home values

Low supply and strong demand have raised house prices.

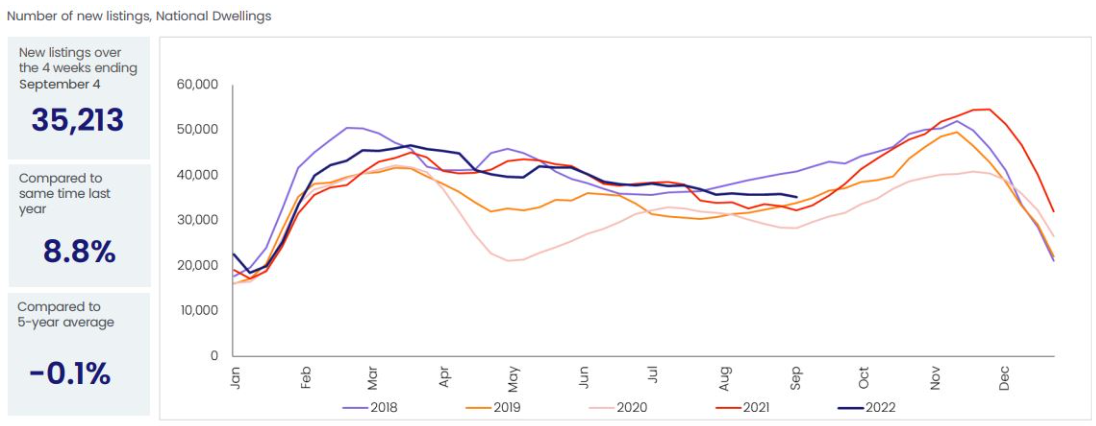

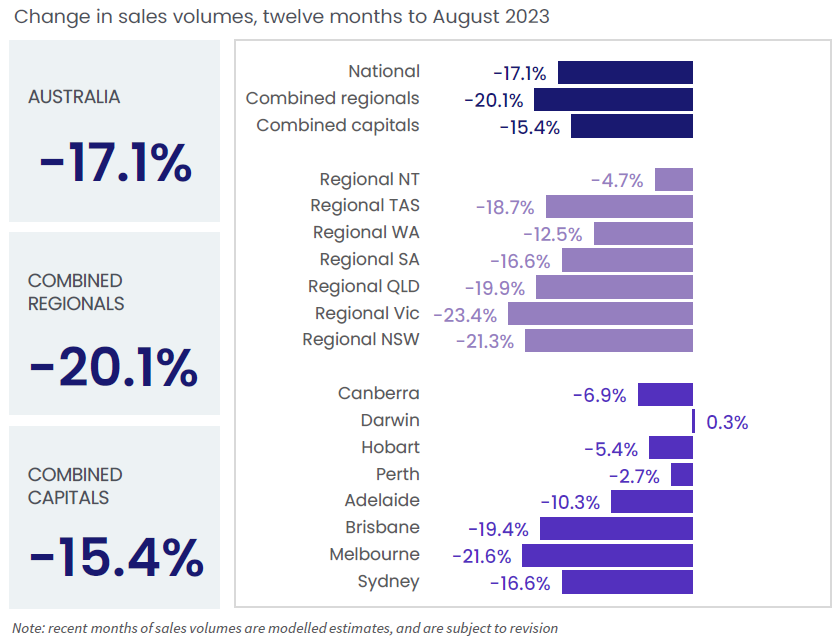

Listings and sales

Supply levels are -15.5% lower than a year ago across major capitals and nearly -19% below the previous five-year average.

Perth, Adelaide, and Brisbane have notably low supply levels, more than -40% below the previous five-year average. Total listings in Australia were around 136,000 in the four weeks ending September 3rd, -23.4% below the previous five-year average.

CoreLogic estimates 38,149 sales in August, slightly below the historic five-year average.

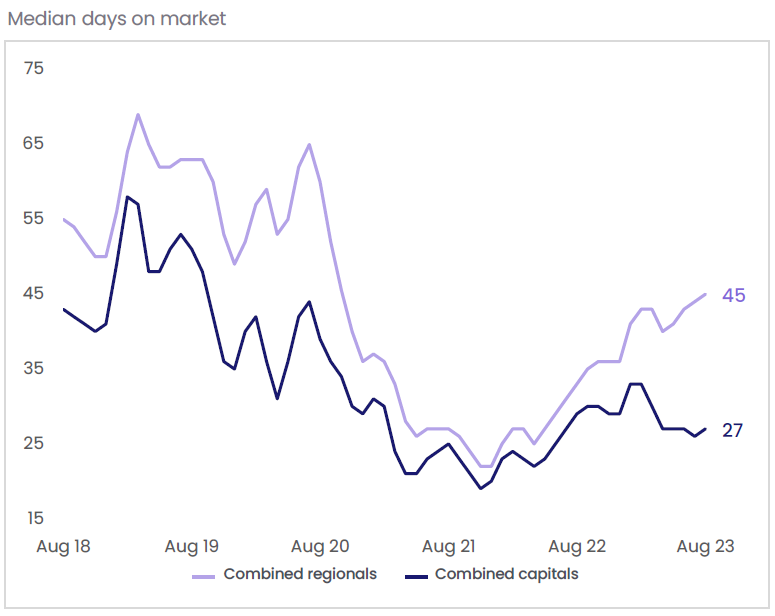

Properties are taking longer to sell, with a median of 32 days on the market in the three months to August, up from 30 days earlier.

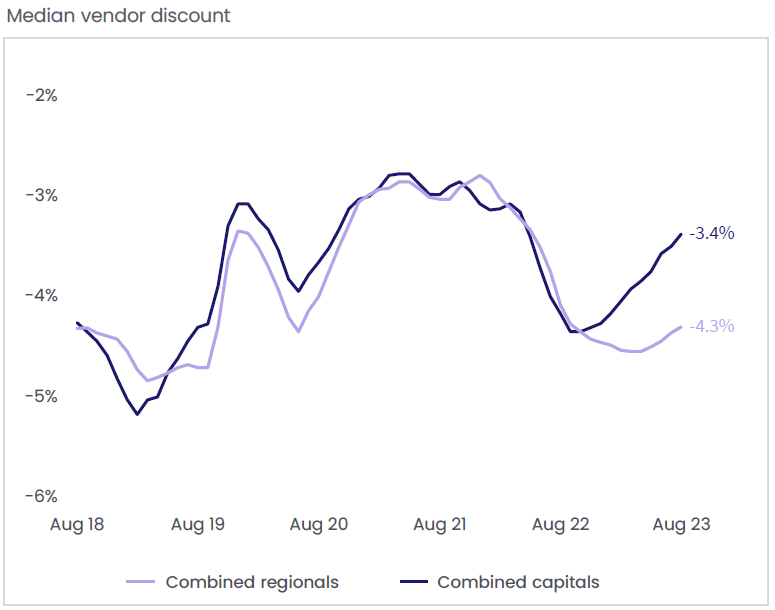

Vendor competitiveness

Due to market competitiveness, vendors can afford to offer smaller discounts on their properties. The national median vendor discount was -3.8% in the three months to August, up from a recent low of -4.3% at the end of last year.

Dwelling values

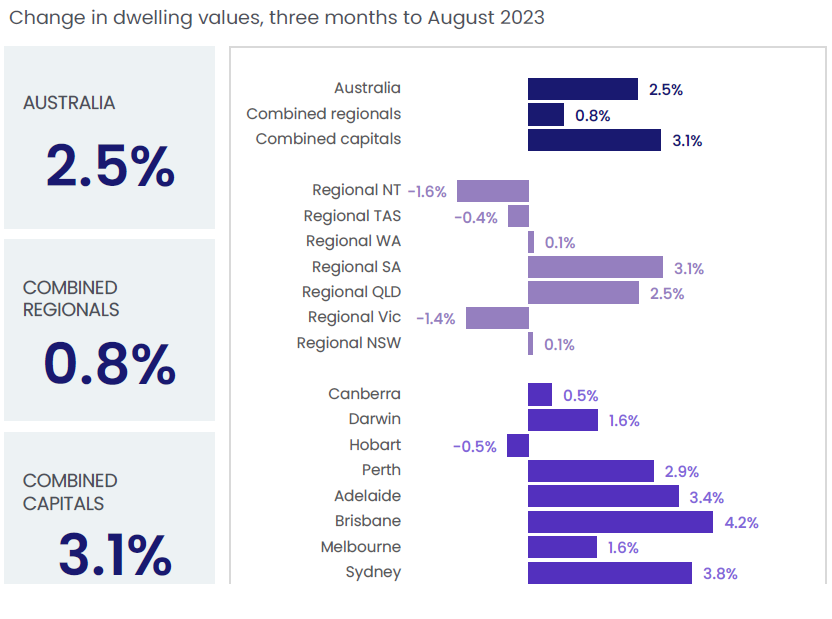

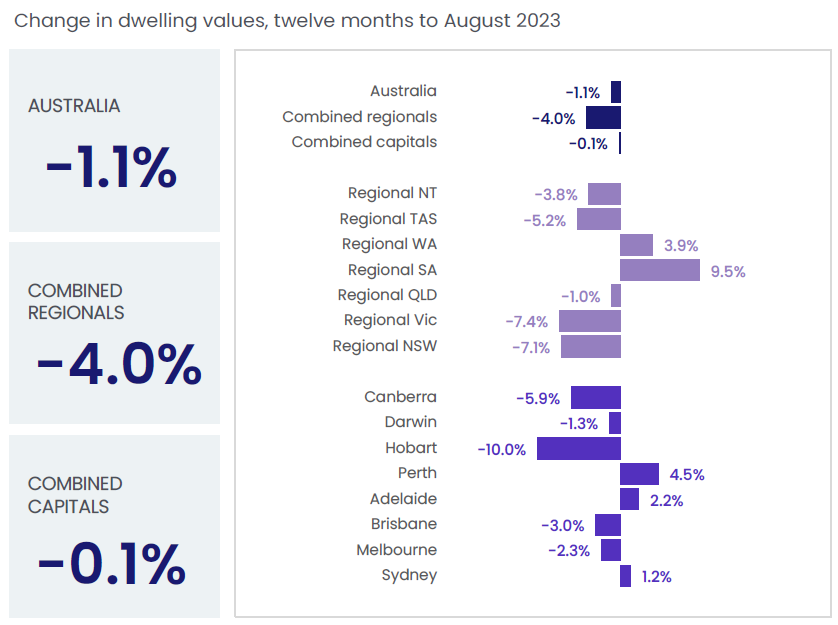

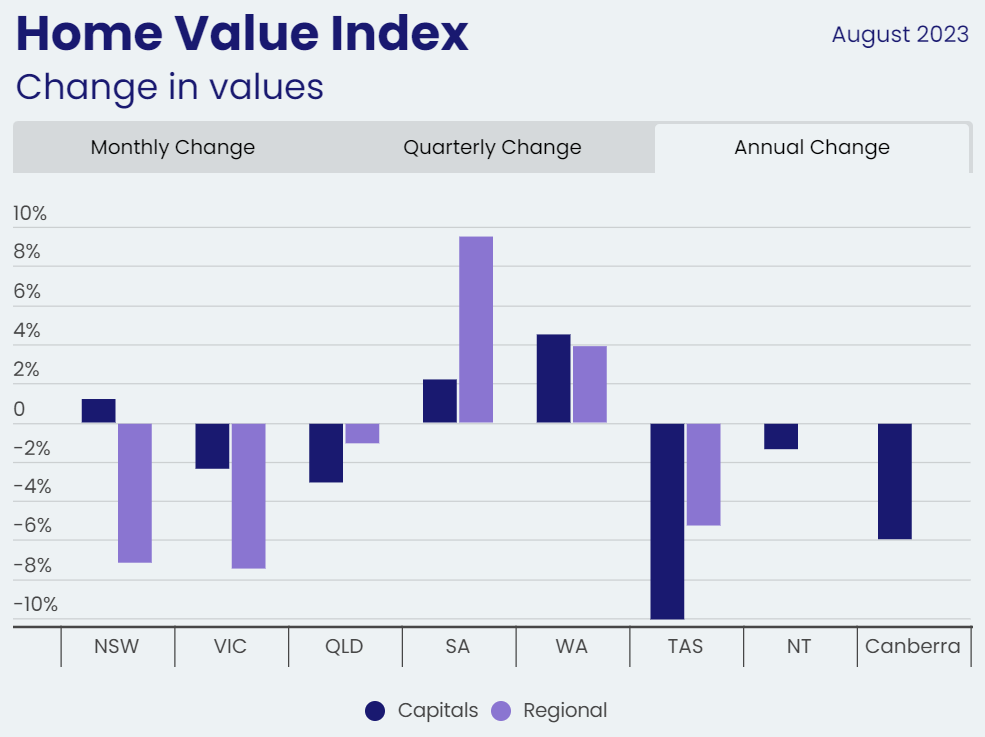

Nationwide, home values increased by 2.5% in the three months to August, slightly down from 2.9% growth in the previous three months. Brisbane and Sydney experienced the highest growth among capital cities, with regional South Australia and regional Queensland leading in regional areas.

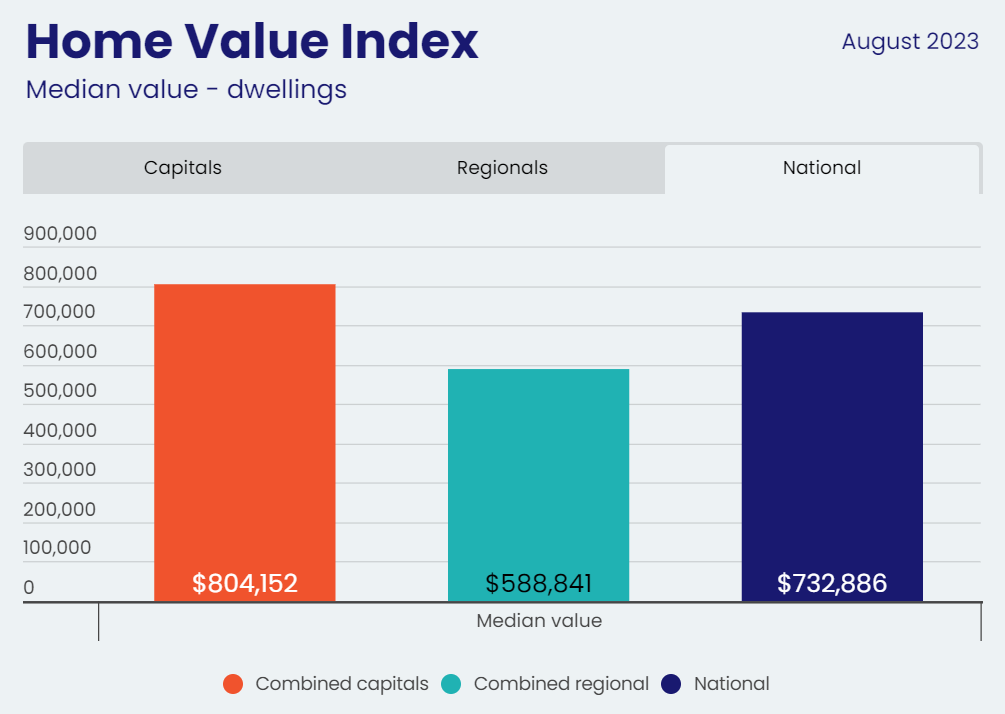

The combined capitals’ median value is $804k, combined regional areas stand at $588k, and the national average is $733k. Sydney boasts the highest value for capital at nearly $1.110m, while Darwin records the lowest at $496k for regional.

In capital cities, house values have experienced a stronger recovery compared to units. Since hitting a low point in February, house values have risen by 6.3%, surpassing the 4.9% increase in unit values.

This significant uptick in house values follows a more substantial decline during the previous downturn, with house values falling by -10.7% compared to a -6.5% drop in unit values.

What about the rental market? We’re still in a rental crisis

The current rental market continues to present challenges for renters but offers favourable signals for property investors.

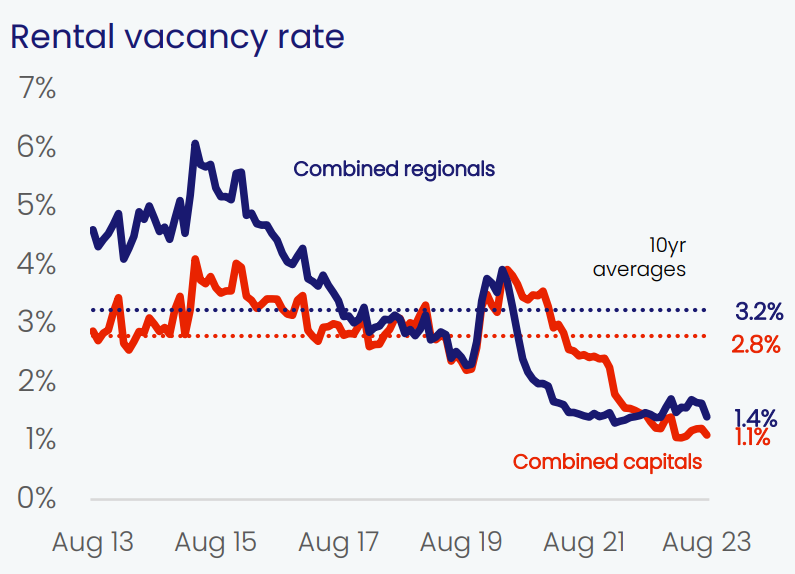

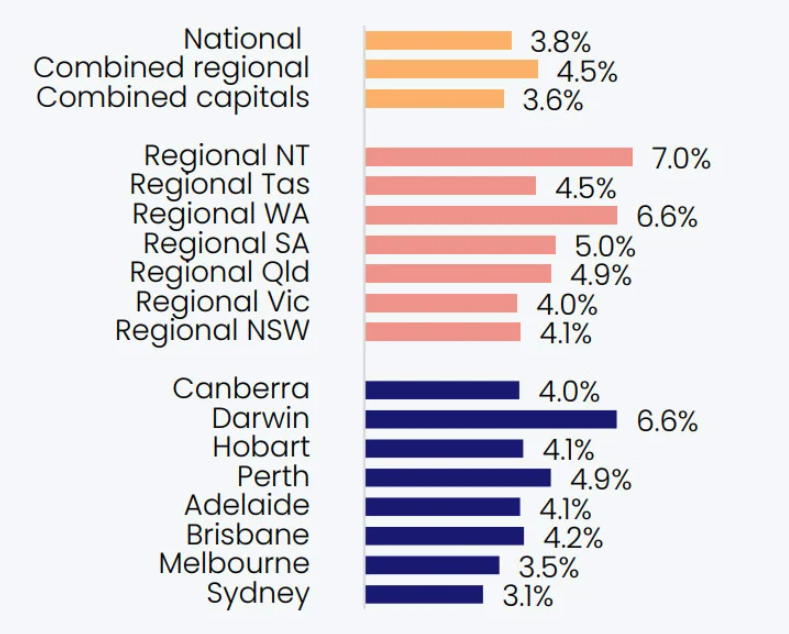

Rental vacancy rates are historically low, with a national vacancy rate of 1.1% in combined capitals, and regional vacancies also declining to 1.4%, marking the lowest since November 2023. Across all capital cities, there has been a consistent reduction in total rental listings, highlighting persistent concerns about limited rental supply.

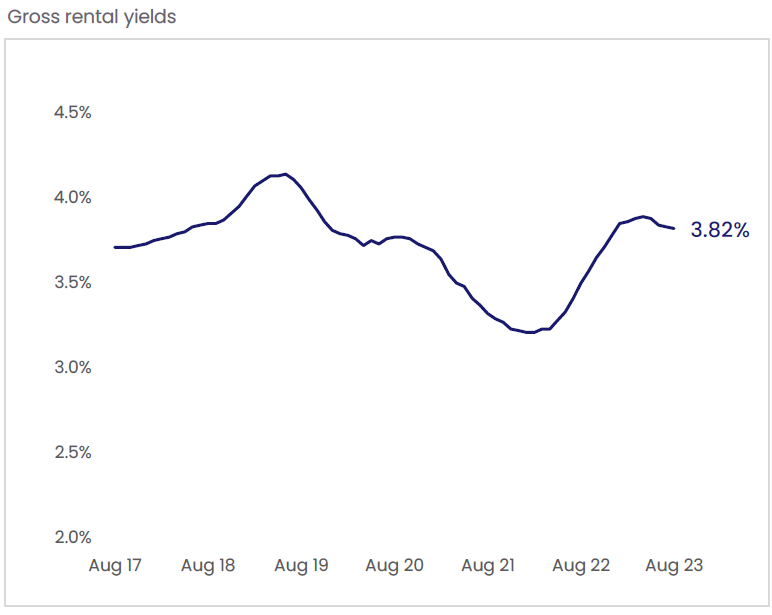

Gross rental yields have gradually decreased, falling from a peak of 3.89% in April to 3.82% in August. This trend reflects housing values increasing at a slightly faster rate than rental rates since May. According to Tim Lawless, executive research director of CoreLogic Asia–Pacific, “We are likely moving past the peak in gross rental yields as housing values continue to rise and rental growth slows.”

Rent values experienced a 0.5% increase in August, contributing to an annual growth rate of 9%, which remains higher than the average of the past decade but shows signs of moderation. The monthly rise in national rents was the smallest observed since November 2020.

However, not all investors are experiencing uniform benefits. While rent values increased by 0.5% nationally, purchase values saw a larger 0.8% rise. Consequently, this led to a slight reduction in the national gross rent yield from 3.83% in the previous month to 3.82%.

As the housing market progresses through an upswing and rent increases slow down, yields are expected to experience mild compression in the short term.

What about interest rates?

In September, the Reserve Bank of Australia (RBA) kept the cash rate stable at 4.1%, marking the second consecutive pause in rate increases. The decision to maintain the cash rate reflects the RBA’s aim to strike a sustainable balance between supply and demand, albeit amid economic uncertainty.

While the RBA believes that inflation has passed its peak, it remains above the target and is not expected to return to the target until 2025.

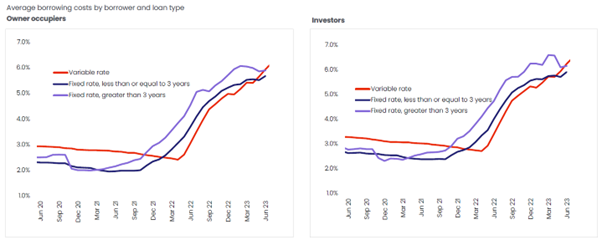

As of June, average new variable mortgage rates stood at 5.94% for owner-occupiers and 6.24% for investors.

Interestingly, average new fixed rates, with terms exceeding three years, are now slightly lower than average variable rates for both borrower types.

According to Tim Lawless, CoreLogic Asia–Pacific’s executive research director, the reduction in inflation compared to forecasts is easing cost-of-living pressures, diminishing the risk of higher interest rates. The combination of lower inflation and the growing expectation that interest rates have reached their peak should gradually boost consumer sentiment.

This, in turn, will support significant financial decisions, such as buying or selling a home.

Exploring property investment?

Property investment offers numerous advantages, such as tax reduction, debt reduction, wealth generation and retirement planning.

Wealth Street’s proficient team is here to navigate the complex terrain with you, offering expert guidance, extensive knowledge, and invaluable education for a prosperous investment voyage. Let us help you today.

Get Started

Every success story starts with a leap of faith. Start a conversation with us.