Australian property prices defying interest rate rises: CoreLogic July housing chart update

17 July 2023

Abdullah Popal

Managing Director

Despite the recent increase in interest rates, house prices in Australia continue to climb. The latest CoreLogic Monthly Housing Chart Pack, showing data for June, provides valuable insights on Australia’s residential property market and here is what you need to know if you are thinking about investing in Australian residential property.

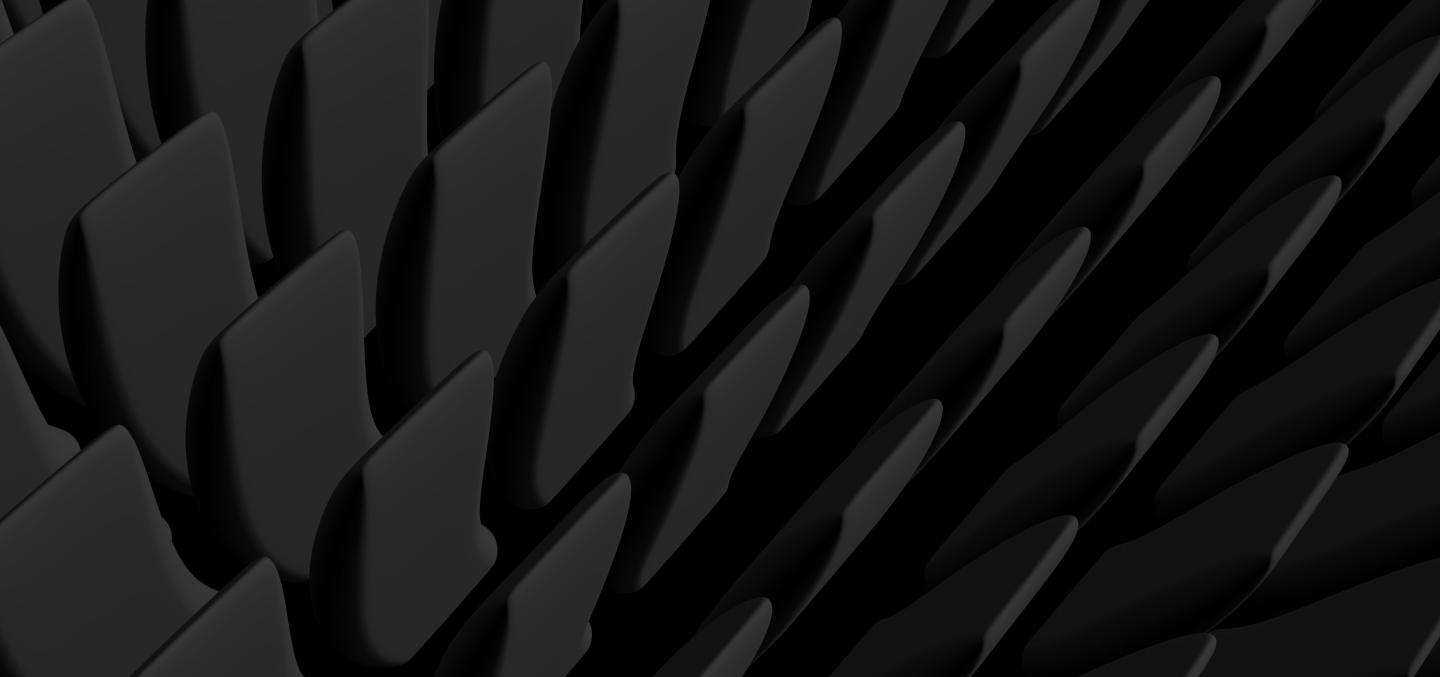

National home values rose by 2.8% over the June quarter – the highest quarterly movement since January 2022

One of the key factors contributing to the surge in home sales is the persistently low levels of available housing supply. The market is grappling with a shortage of housing options, leading to intensified competition among buyers. As a result, buyers are becoming more competitive directly impacting on the overall growth of national home values.

Australia has multiple property markets – offering various opportunities for investors to enter at various stages of their market cycles.

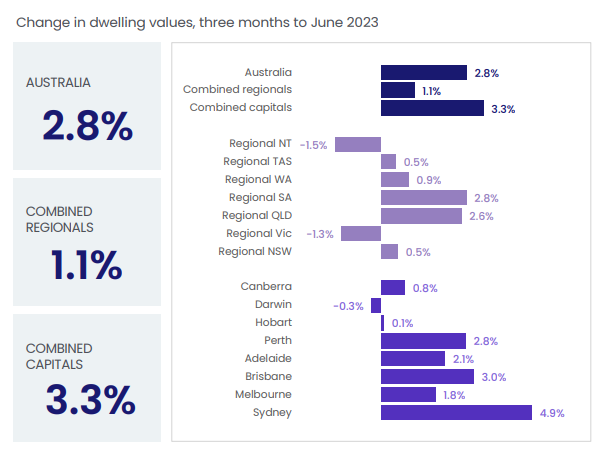

While the property market as a whole is experiencing growth, capital city markets rose 1.2% in June, outperforming regional markets. In June, values in the capital cities grew at more than twice the pace of regional markets where values increased by 0.5%. This discrepancy highlights the varying degrees of growth and demand between urban and regional areas.

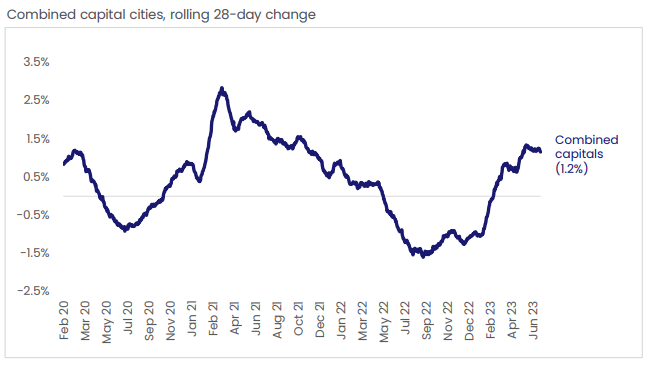

Sales volumes are stabilising

According to CoreLogic estimates, there were 35,523 property sales recorded nationally in June. While this number falls slightly below the five-year average, it indicates a significant volume of transactions taking place in the market.

Despite a decline from the peak levels witnessed in 2021, the six-month moving trend suggests that sales volumes are stabilizing. This stabilization is an encouraging sign, indicating a more balanced and sustainable market condition compared to the previous highs. This can provide investors with a greater sense of stability and confidence in their investment decisions.

The ongoing activity in Australia’s property market, with thousands of transactions occurring monthly, indicates that there are still ample investment opportunities available.

We’ve moved into a seller’s market

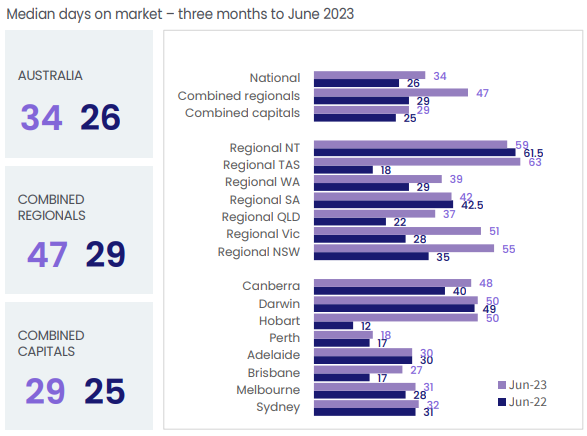

Across the nation, the median days on the market for selling a property increased to 34 days in the June quarter. This is a slight uptick from the recent low of 30 days observed in the three months leading up to April.

The latest statistics indicate that the median vendor discounting rate has dropped to its lowest level in over a year. This means that sellers are offering fewer discounts on their listed properties, suggesting a higher demand for housing and increased competition among buyers.

Supply of new investment grade properties remain low

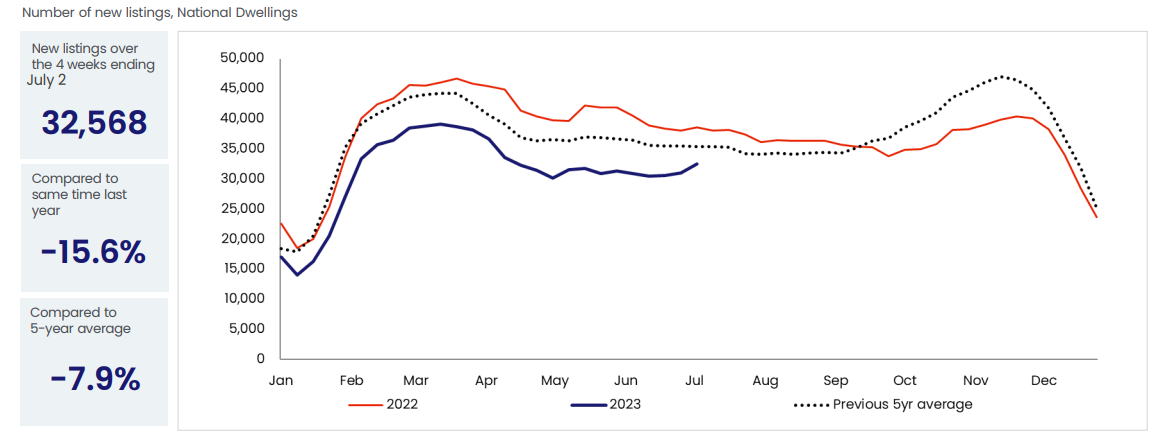

In the four weeks leading up to July 2023, the number of new listings in the market remained low. With 32,568 newly advertised properties added for sale, there has been a slight increase, which is uncommon for this period. However, new listings volumes continue to be lower compared to previous years, 7.9% lower than their historic five-year average.

The scarcity of new listings means that investors may face a limited selection of properties to choose from. This can make it challenging to find suitable investment-grade or A-grade properties, which are often in high demand.

With a lower volume of new listings, the market becomes more competitive, as multiple buyers compete for a limited number of properties.

Owners of quality properties are more likely to hold onto them in such a market. This means that investment-grade properties may be less readily available, potentially impacting the quality and profitability of investment opportunities.

Auction clearance rates confirm a market bounce back

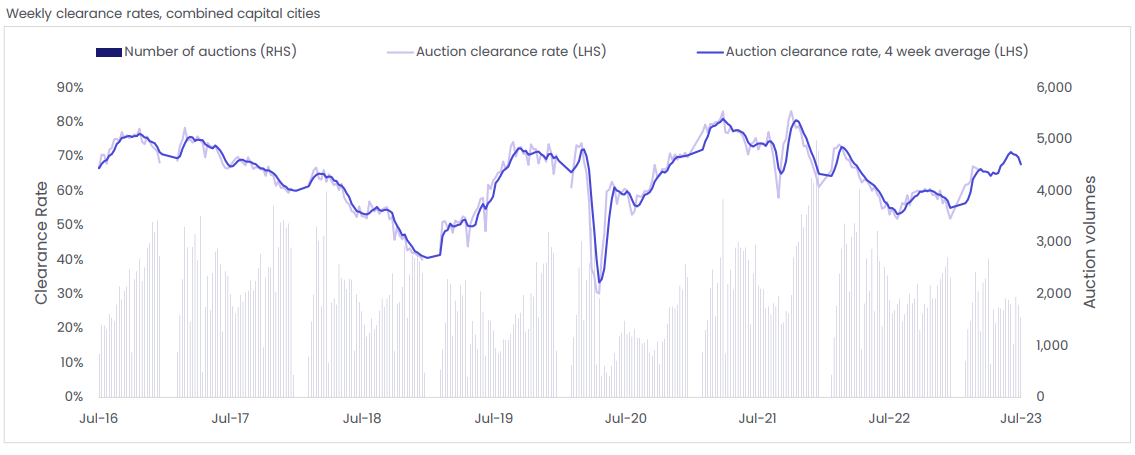

Following the conclusion of mid-winter holidays, the weekend auction markets in Australia have regained their momentum, showing strong activity. The national auction clearance rate averaged 67.7% in the four weeks ending 2 July 2023 and was higher than the same period last year.

This indicates renewed interest from both buyers and sellers and an overall positive market sentiment.

Rental market in Australia reaches a critical point: An unprecedented crisis

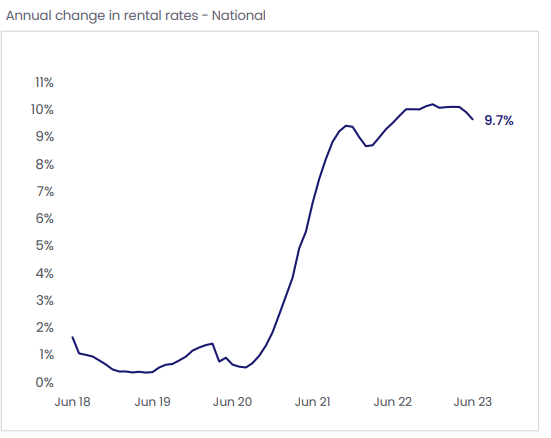

The rental market in Australia has experienced significant growth, with rents rising by 9.7% over the year. This growth far exceeds the decade average of only 3% per annum. Investors who have already secured tenants or plan to enter the rental market can enjoy higher rental income and improve their cash flow.

Promising housing finance trends signal opportunities for investors

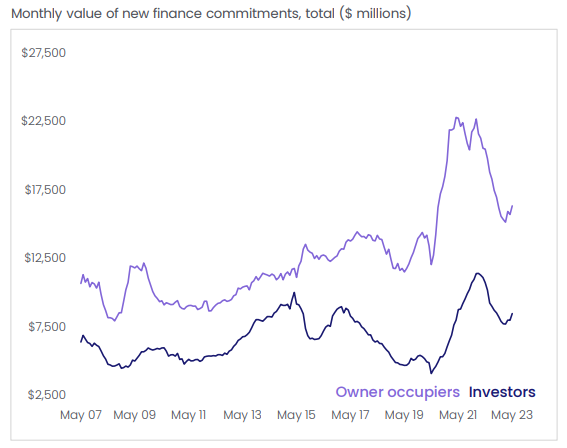

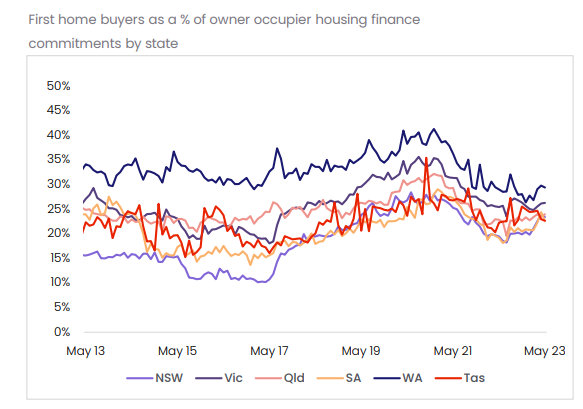

May witnessed a noteworthy 4.8% surge in the combined value of secured housing finance, reaching close to $25 billion. This growth is indicative of favourable prospects for both owner-occupiers and investors. Investor finance saw an uptick, accounting for 34.2% of new mortgage lending, surpassing the previous month’s figure of 33.7%.

Simultaneously, the value of first home buyer finance rose by 5.5%, comprising 25.4% of owner-occupier finance, surpassing the decade average of 23.8%. These developments in housing finance serve as leading indicators for the property market, suggesting increased loan approvals and an upward trajectory for property purchases, presenting enticing opportunities for investors.

So why are Australia’s property prices continuing to go up?

- Record Migration – Australia is experiencing an influx of migrants , and many of them eventually want to buy homes. The forecast is 400,000 in 2022-23 and 260,000 in 2024-25. This growing population, combined with Australia’s housing supply shortage, drives demand. Consequently, the federal budget anticipates an influx of 1.5 million net overseas migrants to Australia during the period spanning from 2021 to 2026-27, which is equivalent to the population of Adelaide.

- Limited New Construction – There aren’t enough new homes being built to meet the demand. The number of building approvals is at a 13 year low according to data from the ABS and Treasury secretary Steven Kennedy expects the downturn in building approvals to continue until 2024 – further exacerbating Australia’s housing supply crisis.

- A resilient labour market: Even with Australia’s interest rate rises, Australia’s labour market is strong and unemployment rate remains relatively low. This stability in employment is supporting household incomes and preventing widespread mortgage stress and defaults.

The Australian property market continues to defy rising interest rates, thanks to strong demand, limited supply, and various factors supporting price growth. While there are signs of a potential slowdown, the market remains resilient.

Understanding the underlying factors driving the housing market’s performance is essential for making informed decisions. With property prices on the rise, it’s important to take a long-term perspective and leverage market analysis to achieve success in property investment.

Property investment is a complex process. Make informed investment decisions and demystify the process of your investment journey with expert guidance, comprehensive knowledge and valuable education.

"Understanding the underlying factors driving the housing market’s performance is essential for making informed decisions. With property prices on the rise, it’s important to take a long-term perspective and leverage market analysis to achieve success in property investment."

Abdullah Popal

Managing Director

Get Started

Every success story starts with a leap of faith. Start a conversation with us.