Houses vs units; which is the better investment property in Australia?

04 September 2023

Abdullah Popal

Managing Director

Whether you’re taking your first step or expanding your portfolio, the property investment journey can be complex. Making the wrong decision causes years of financial challenges. However, finding the right investment property can offer a passive income and a portfolio that sets you up for future success. There’s also potential for portfolio diversification, building long-term wealth and securing retirement.

With many options on the market, one of the decisions you’ll need to make is choosing between a house or unit for your investment property in Australia.

Each property type has its benefits and considerations, and understanding the key differences is crucial in making an informed choice that aligns with your strategy.

In this article, we’ll look at standalone houses vs units and apartments.

We’ll navigate some key factors that can help your decision-making and empower you to decide which property resonates best with your financial needs and risk appetite.

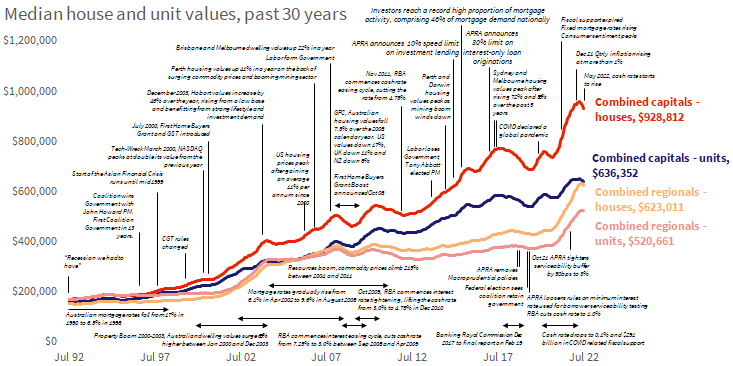

Houses generate more long-term capital growth

The long-term lifestyle trend has seen property prices for houses rise substantially more than unit prices. Across Australia, house values are up 453% over the past 30 years, compared to units where values are 307% higher.

The property market in Australia is fragmented, resulting in diverse performance across regions. In Queensland, investors can uncover strong growth opportunities in regions such as Ipswich and Moreton Bay, fueled by population growth and strategic positioning of valuable land within the region.

During periods of economic downturn, houses have demonstrated remarkable resilience, highlighting superior growth and increased rental yields. This phenomenon is attributed to the appreciation of land value over time. However, the pivotal role of location should not be overlooked, as it consistently remains a critical factor to consider.

The latest data from CoreLogic also shows houses outperforming apartments and units. House prices have exhibited a more pronounced upward trend in recovery compared to unit prices. Across all capital cities, house values have surged by 6.3% since reaching their lowest point in February, outpacing the 4.9% increase seen in unit values.

Units may present initial affordability, but the larger land-to-building ratio associated with houses gives them an advantage, making houses a cornerstone of property investment.

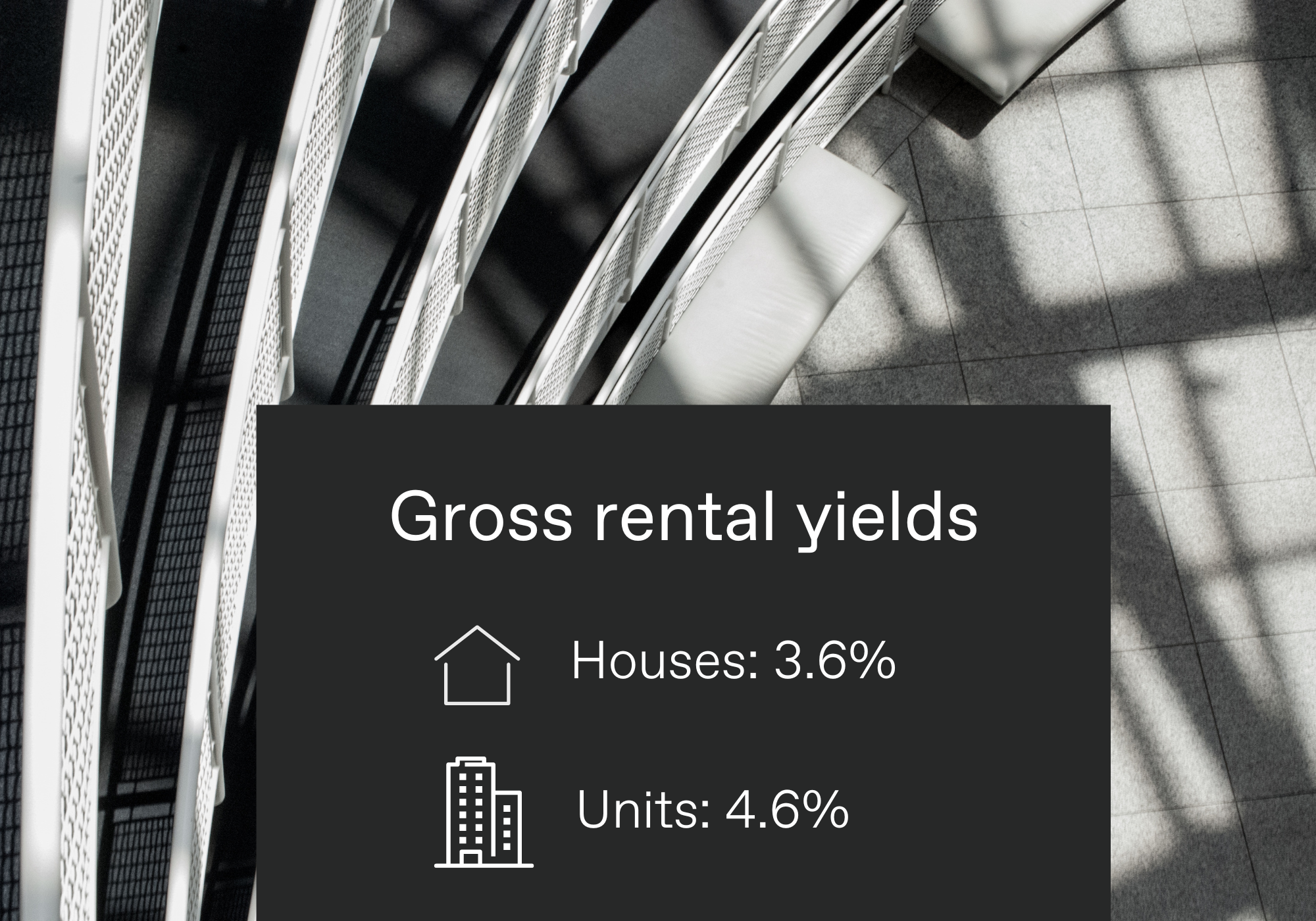

Rental yields, cash flow and tax benefits

Rental yields can tell you a lot about how much money you can earn from your investment property as an income. After all, you want something that sustains regular rent. Gross rental yields for houses are currently around 3.6% compared to units which are at 4.61% (CoreLogic March 2023). Although historically units and apartments have boasted more higher rental yields than houses, it’s important to note that investing in houses come with distinct tax advantages.

For property investors, the acquisition of a new house carries superior depreciation benefits for tax considerations compared to purchasing an established property.

In addition to depreciation benefits on new properties, ensure you consider other factors that can affect your cash flow:

- Property management expenses

- Maintenance costs

- Strata fees (for units)

- Insurance

- Water rates

- Council rates

How to match your investment property strategy with goals

Define your property goals before choosing between a house or unit for investment. If you want to build long-term wealth, the type of dwelling and location can make all the difference.

Consider the growth potential by weighing up location, property type, affordability, government/regulatory infrastructure, amenities and demand.

Evaluate your financial situation and objectives by:

- Considering your property investment strategy, e.g. focusing on solid capital growth areas vs. rental yield and cash flow.

- Taking advantage of tax benefits and Government incentives

- Determining your risk tolerance

- Talking to the right people – mortgage brokers, and property and financial experts

- Exploring all finance options

So, is buying a house a good investment?

When deciding on an investment property in Australia, it’s important to consider how much the overall property will appreciate over time while ensuring strong cash flow, keeping in mind that land appreciates and dwellings depreciate.

Houses offer long term capital growth opportunities but can come with higher maintenance expenses. Units lack land value but generally have a more affordable entry cost.

But the final decision should be based on your own investment strategy aligned to your personal financial situation and goals, as well as how much risk you’re willing to accept.

If you are wondering which type of property is the best investment for your financial situation, Wealth Street offers support and guidance so you can reach your financial goals faster. Take your first step to connect with us here.

Get Started

Every success story starts with a leap of faith. Start a conversation with us.