3 things you need to know on why time in the market is more significant than obsessing over market timing.

Successful investors understand that taking action and creating wealth at any point of the market are crucial steps in creating long-term wealth. While timing holds some significance, finding the right property with strong fundamentals ultimately outweighs the importance of perfect market timing.

1. The power of compounding

Time in the market allows investors to harness the magical power of compounding growth and accumulate wealth over the long term. Let’s illustrate this with an example. Consider a property investment of $500,000 over 20 years, assuming an average annual capital growth of 5%. The compounding effect gradually magnifies your returns. In this case, the initial investment grows to an impressive $1,330,305 over the 20-year period. Each year’s growth contributes to the increased value of the property in subsequent years, showcasing the immense potential of compounding growth.

2. Weathering market cycles

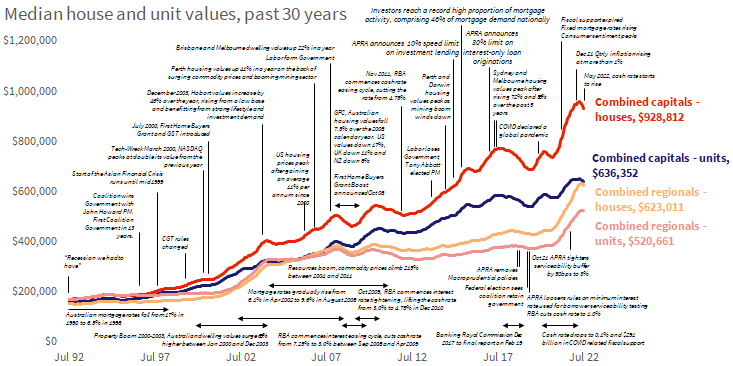

Australia’s property market is cyclical in nature with multiple property markets – some experiencing downturns while others show growth potential.

History has shown that Australia’s housing values move through cycles of upswings and downturns, yet the long-term trend is upward. Over the past 30 years, national dwelling values increased by an impressive 392%, reflecting an average annual compound growth rate of 5.4% since July 1992, as highlighted by CoreLogic data.

These findings not only highlight the remarkable appreciation in Australian property values but also underscore the long-term benefits of home ownership. It’s clear that investing in real estate has proven to be a lucrative venture for those who have embraced it with patience and foresight.

3. Booms and busts are temporary

Booms and busts are just temporary phases that are bound to occur in the market. By having a solid wealth strategy in place with investments decisions made without being driven by emotions, you can protect yourself from the hype of booms and busts.

Trust in the power of time and the potential for long term growth

Staying committed to your properties over the long term brings stability and unlocks long-term returns.

By remaining invested over the long term, focusing on quality, well located, investment-grade assets and having a solid wealth strategy in place, you can navigate the ups and downs of market cycles with confidence allowing property values to appreciate steadily.

Trust in the power of time and the potential for long-term growth in the property market rather than the specific timing of your purchase.

If you are wondering if now is the right time to buy, sell or wait, we’re here to help. Wealth Street can help you devise a strategic investment plan based on your goals, objectives and financial numbers.

Through our combined finance and investment expertise, we help everyday Australians reduce debt and create wealth through our combined finance and investment expertise:

- Eliminating debt sooner and helping you pay off your loan faster

- Minimising your tax liability

- Grow your wealth

"Trust in the power of time and the potential for long-term growth in the property market rather than the specific timing of your purchase.”

Abdullah Popal

Managing director

Get Started

Every success story starts with a leap of faith. Start a conversation with us.