Unlocking tax benefits for your property investor clients

25 June 2023

Key takeaways

- New builds offer property investors significantly more tax benefits than existing builds.

- The two ways property investors can claim depreciation are building allowance and depreciating assets.

- Depreciation claims on existing property built prior to 2020 are maxed at $65,000 over 10 years. New properties built after 2020 can claim depreciation of up to $100,000 over 10 years.

We know you work hard to secure an investment loan for your clients. But, what happens once the loan is pre-approved? Your dedication to your client doesn’t have to stop there. Most of the time, your clients don’t know that investing in a new build comes with additional tax benefits as opposed to investing in an established property.

As we approach tax time, it’s a good idea to proactively engage with your clients and discuss tax benefits associated with their investment property portfolio. Understanding and leveraging these tax advantages can significantly impact your clients’ financial outcomes.

This article explores the various tax advantages available to property investors in Australia, and the differences between claims for existing properties versus new builds.

What is property depreciation?

As a property ages, its value declines. This is called property depreciation.

Property investors can claim this decline in value as a tax deduction, helping them to pay less tax as long as the types of depreciations they claim fall within the guidelines set out by the Australian Taxation Office (ATO).

Claiming depreciation

There are two ways property investors claim depreciation: capital works deductions (aka building allowance) and plant and equipment (otherwise known as depreciating assets).

- Division 43: Capital works deductions (building allowance)

These are the construction costs associated with building an investment property. Sometimes it’s helpful to think of these as the items you can’t remove from the property like the walls, roof, doors, bathroom fixtures like the bathtubs and toilets.

The wear and tear on these items are deductions which investors can claim. Approximately 98% of the construction cost of a new property can be claimed (excluding landscaping and any demolition of previous properties on the land).

The ATO dictates that this is spread over a maximum of 40 years at a rate of 2.5% per year for properties built after September 15, 1987. Consider this example from NAB:

- New build cost: $200,000

- Tax claim: $5,000 each year for 40 years (i.e. 2.5 per year).

For the full list, refer your client to the ATO’s capital work deductions guide.

- Division 40: Plant and equipment (depreciating assets)

Depreciating assets are the movable items like kitchen and laundry appliances and floor and window coverings.

There are over 6,000 depreciable assets recognised by the ATO, which assigns these plant and equipment assets an “effective life” and relevant depreciation rate. The ATO has this online tool available for clients to calculate ahead of filing their tax returns.

Not all deductions are equal: new builds versus existing builds

New builds have an advantage over existing builds as property investors can claim deductions for the cost of both the construction costs and new fittings and fixtures installed into the property. New properties often offer greater depreciation deductions due to the higher value of plant and equipment assets and the potential for higher construction costs.

In terms of established builds, current legislation stipulates that owners of second-hand residential properties, who have exchanged contracts after the 9th of May 2017, cannot claim deductions for previously used plant or equipment assets.

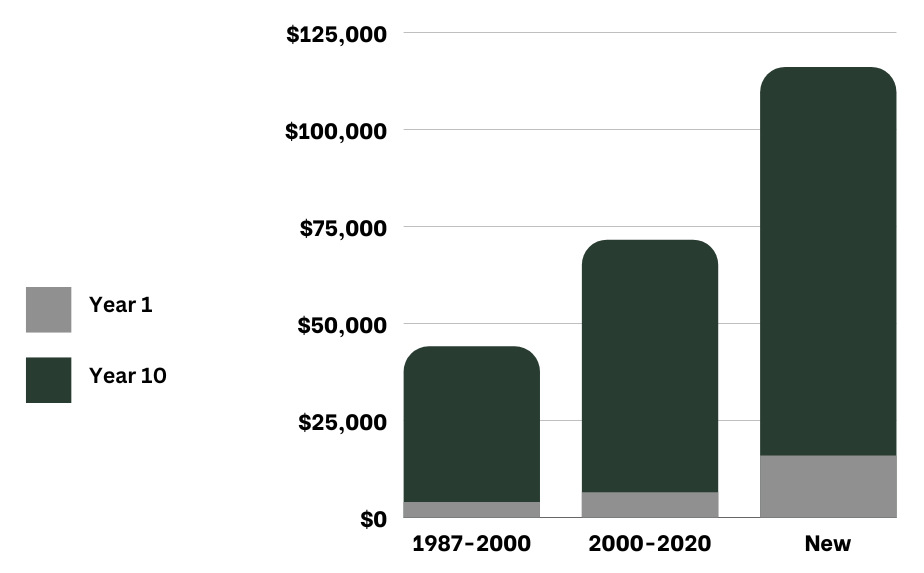

According to estimates published in this Canstar article, the deductions an investor can claim vary widely;

- Property built between the years 1987 and 2000: can claim roughly $4,000 in deductions a year, or close to $40,000 over the first 10 years.

- Property built between the years 2000 and 2020: can claim around $6,500 a year, or close to $65,000 over the first 10 years.

- Brand new property: can claim approximately $16,000 in year one and close to $100,000 over the first 10 years.

Source: Wealth Street

Here are two guides your client may find useful:

As a mortgage broker, your role extends beyond securing loans for your clients. By understanding the tax benefits available to property investors in Australia, you can play a vital role in empowering your clients to make informed decisions and maximise their investment potential.

Having these check-ins with your clients empowers them to make informed decisions and optimise their investment potential while securing their mortgage financing. By highlighting the potential tax benefits of newly built properties, you enable your clients to make informed investment decisions aligned with their financial goals.

Get Started

Every success story starts with a leap of faith. Start a conversation with us.