An Australian-first: Wealth Street integrates into Finsure’s CRM

19 September 2023

John Zada

FOUNDER | CEO

In a groundbreaking partnership, Wealth Street has seamlessly integrated with the Finsure CRM, marking an unprecedented move in the Australian financial landscape.

Starting October 2023, Finsure brokers will gain the option to refer pre-approved investment clients to Wealth Street’s Investment Property Experts via Infynity.

This collaboration signifies a major milestone in our relationship with Finsure, one of ANZ’s premier mortgage aggregators, elevating us from panel members to trusted property partners.

Since 2020, our presence on the esteemed Finsure panel has allowed us to assist countless broker’s clients in reducing debt, optimising tax, building wealth and preparing for retirement. We are deeply appreciative of the collaboration with brokers who share our commitment to going beyond securing pre-approved loans for their clients.

Having been founded by ex-mortgage brokers, we understand the challenges brokers face, from clawbacks and wasted pre-approvals to short-term loan clients and serviceability constraints.

This integration represents a revolutionary leap for broker’s businesses, opening the potential for an additional and lucrative commission stream that is fully endorsed and supported by Finsure.

Why Wealth Street?

Recent Finsure data has revealed a staggering statistic: nearly 50% of investment pre-approvals submitted through Finsure expire within 90 days. This alarming trend equates to a monthly loss of $1 billion in loan applications*.

Several factors contribute to this issue, including limited investment opportunities, insufficient borrower knowledge regarding sound investment strategies, and the scarcity of available stock.

Wealth Street solves this by seamlessly connecting your pre-approved property investment loan clients with exclusive off-market investment-grade properties.

Our approach combines a tailored investment strategy, access to premium investment-grade stock and a commitment to educating investors about property investment at every touchpoint.

Digging into the data

The aforementioned statistic is not just eye-opening; it holds several important takeaways:

- Dedication to pre-approvals: Securing pre-approvals is no small feat, requiring significant effort and time investment on your behalf, often without guarantees of success.

- Industry-wide productivity: This situation underscores an opportunity for our industry to collectively become more efficient.

- Demand for diversification: Clients are increasingly seeking diversified services from brokers.

- Clients seek guidance: It’s clear that clients are seeking more guidance and information from their brokers.

- Addressing business gaps: There may be knowledge and resource gaps in some businesses that, in collaboration with Finsure, we can address.

- Finsure’s commitment: Finsure recognises the importance of this area and is committed to collective improvement.

- Prioritising client outcomes: Obsession to serve our clients is essential for business longevity.

- Navigating the changing landscape: Rising interest rates, inflationary pressures and reduced borrowing capacity, requires our attention and adaptation for the benefit of our clients.

Wealth Street is not merely another property service provider. Our journey begins by comprehensively understanding your client’s financial goals and formulating short, medium and long-term plans. We leverage property to help clients achieve these life-changing objectives.

Benefits for brokers

Wealth Street is not just a property venture; we are strategic partners invested in your business’s growth and success. This is achieved through effortlessly diversifying with Wealth Street.

By increasing the conversion rate of pre-approved investment loans, you stand to gain in multiple ways:

- Greater productivity: Reduced re-applications lead to enhanced productivity.

- Enhanced commissions: Higher commissions from settled investment loans.

- Increased income: Additional commission streams boost your business income.

- Loyal clients: Satisfied clients become advocates, providing valuable word-of-mouth marketing.

To top it off, you don’t need to be an investment property expert; you can trust Wealth Street to handle every aspect, keeping you informed every step of the way, ensuring a smooth and successful investment journey for your clients.

We’re dedicated to nurturing your business in various ways, and our integration into Infynity is just the beginning:

- Diversification: Integrating Wealth Street opens doors to diversify your services, fortifying your revenue streams and business resilience.

- Client-centric approach: We prioritise your clients, fostering stronger relationships, more referrals and customer loyalty for you.

- Education and resources: We offer valuable resources, knowledge and tools to empower you to serve your clients better in a constantly evolving industry.

- Efficiency and productivity: Our integration streamlines your operations, allowing you to focus on your clients.

- Network and partnerships: We facilitate industry connections and partnerships that open doors to new opportunities and collaborations.

Benefits for your clients

Your clients embark on an instant and promising journey towards successful investments, guided by Wealth Street Investment Specialists.

Consider the typical client, spending hours researching online, seeking advice in online forums or relying on outdated wisdom from family members. No longer will your clients wander aimlessly or venture down the wrong path.

We transform this experience by adopting a financial-planning approach to property investment.

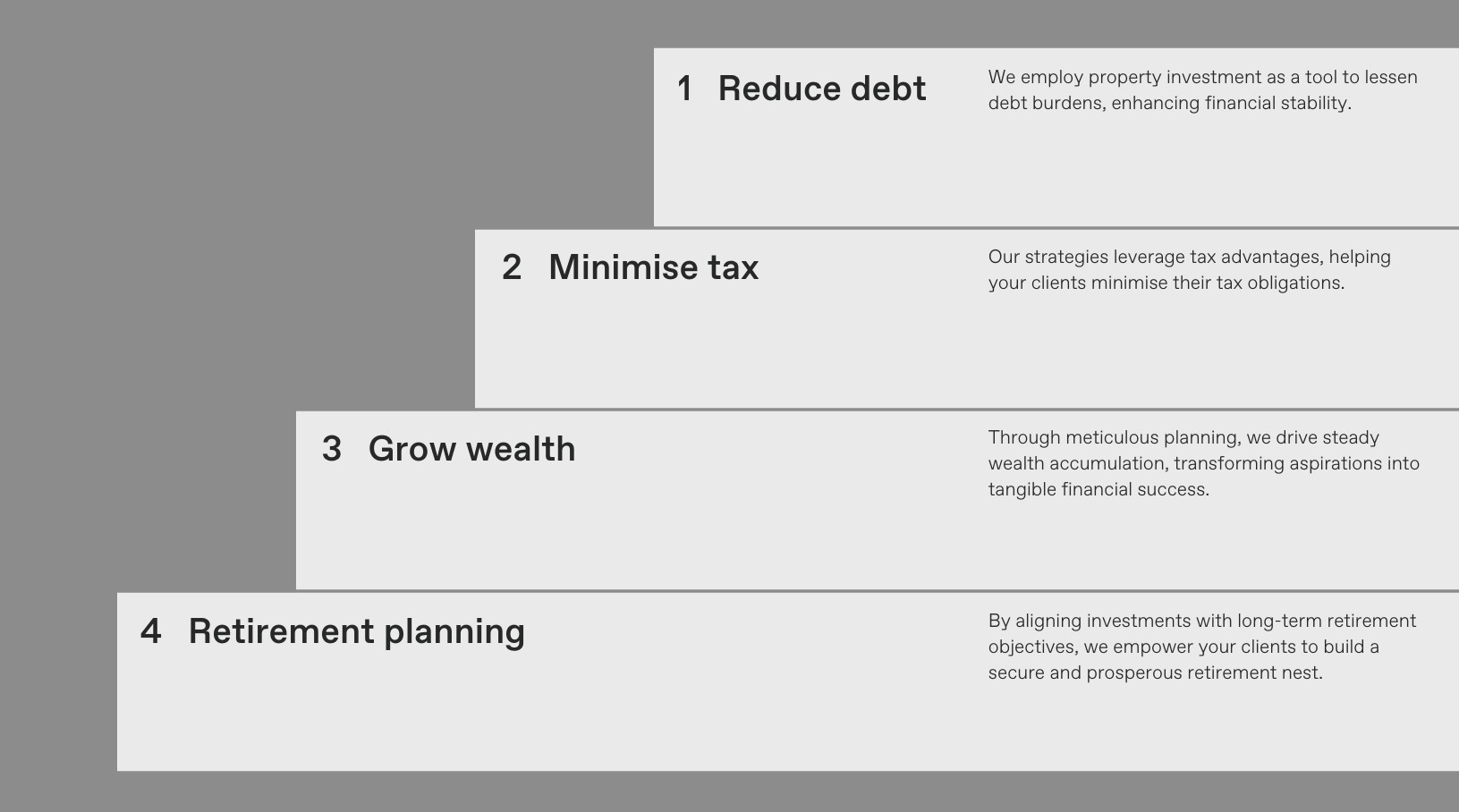

We meticulously analyse your client’s entire financial situation to align their goals with a tailored property portfolio, helping them achieve four primary objectives: minimise tax, reduce debt, generate wealth and prepare for their retirement.

With Wealth Street’s extensive network of industry experts, your clients receive guidance from start to finish, ensuring a straightforward path to prosperity.

Read our investor success stories here.

The straightforward path to prosperity starts here.

Read more about how Wealth Street transforms investment pre-approvals.

Book a broker discovery to learn more.

Start referring your existing pre-approved investment clients today.

Wealth Street has made maximising your income and enhancing your dedication to your clients easier than ever.

John Zada

Founder & CEOGet Started

Every success story starts with a leap of faith. Start a conversation with us.